Get ready to dive into the world of auto loan refinancing options with a fresh perspective. This passage sets the stage for an enlightening journey through the ins and outs of maximizing your savings and getting the best deal on your auto loan.

Let’s explore the various types of refinancing options available and how you can make informed decisions to secure a brighter financial future.

Understanding Auto Loan Refinancing

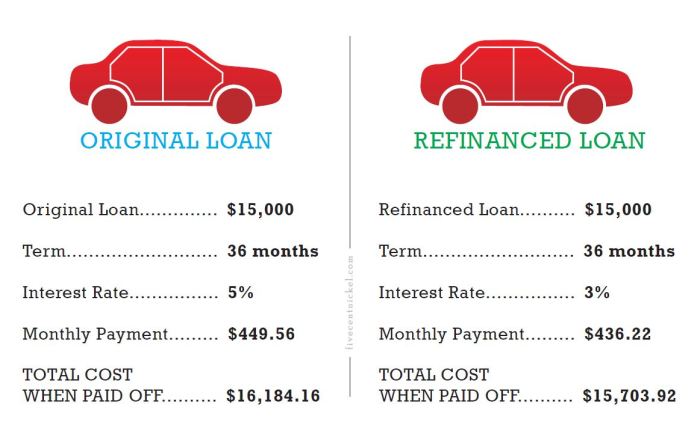

When it comes to auto loan refinancing, it’s all about swapping your current car loan for a new one with better terms. This can help you save money on interest rates and monthly payments, making it a smart financial move for many people.

Benefits of Auto Loan Refinancing

- Lower Interest Rates: By refinancing your auto loan, you may be able to secure a lower interest rate, which can save you money over the life of the loan.

- Reduced Monthly Payments: Refinancing can also lead to lower monthly payments, giving you more breathing room in your budget.

- Improved Credit Score: Making timely payments on your new loan can help improve your credit score over time.

- Flexible Loan Terms: Refinancing allows you to adjust the length of your loan term, giving you more control over your payments.

Factors to Consider Before Refinancing

- Current Interest Rate: Make sure the new interest rate is significantly lower than your current rate to make refinancing worthwhile.

- Loan Term: Consider how changing the length of your loan term will impact your monthly payments and overall costs.

- Fees and Penalties: Be aware of any fees or penalties associated with refinancing to ensure that the savings outweigh the costs.

- Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for, so make sure it’s in good shape before applying for refinancing.

Types of Auto Loan Refinancing Options

When it comes to auto loan refinancing, there are various options available to borrowers. Understanding the different types can help you make an informed decision that best suits your financial needs.

Traditional Bank Refinancing vs. Online Lenders

- Traditional Bank Refinancing:

Pros: Established reputation, in-person customer service, potential for relationship discounts.

Cons: Longer approval process, stricter eligibility requirements, limited options.

- Online Lenders:

Pros: Quick and convenient application process, competitive rates, wider range of options.

Cons: Lack of in-person support, potential for hidden fees, varying customer service quality.

Cash-Out Refinancing Options for Auto Loans

- Cash-Out Refinancing:

Allows borrowers to refinance their auto loan for more than they currently owe, receiving the difference in cash.

Can be used to pay off high-interest debt, make home improvements, or cover unexpected expenses.

Fixed-Rate vs. Variable-Rate Refinancing

- Fixed-Rate Refinancing:

Interest rate remains constant throughout the loan term, providing predictable monthly payments.

Recommended for borrowers seeking stability and protection against potential rate increases.

- Variable-Rate Refinancing:

Interest rate fluctuates based on market conditions, potentially leading to lower initial rates but higher risk.

May be suitable for borrowers who can afford payment fluctuations and are comfortable with market uncertainties.

Eligibility Criteria for Auto Loan Refinancing

When considering auto loan refinancing, there are certain eligibility criteria that borrowers need to meet in order to qualify for a new loan with better terms and rates.

Credit Score Requirements

- A good credit score is typically required to qualify for auto loan refinancing. Most lenders look for a credit score of 660 or higher, but the higher the score, the better the chances of getting approved.

- Having a higher credit score will not only increase your chances of approval but also help you secure a lower interest rate on your refinanced loan.

- It’s important to check your credit score before applying for refinancing to ensure that you meet the minimum requirements set by the lender.

Loan-to-Value Ratio Impact

- The loan-to-value (LTV) ratio is an important factor in determining eligibility for auto loan refinancing.

- Lenders prefer a lower LTV ratio, ideally below 100%, which means the amount you owe on the vehicle should be less than its current market value.

- A lower LTV ratio signifies less risk for the lender and may result in better refinancing options for the borrower.

Income and Employment Requirements

- Income and employment stability are crucial factors that lenders consider when evaluating a borrower’s eligibility for auto loan refinancing.

- Borrowers should have a steady source of income to demonstrate their ability to make timely payments on the refinanced loan.

- Some lenders may require a minimum income level or a specific employment history to qualify for refinancing.

Process of Auto Loan Refinancing

When it comes to refinancing your auto loan, there are several key steps involved in the process. Understanding these steps can help you navigate the refinancing journey more smoothly and find the best options for your specific situation.

Step 1: Evaluate Your Current Loan

- Check your current interest rate, remaining balance, and monthly payments.

- Determine if your credit score has improved since you took out the original loan.

Step 2: Research Lenders and Rates

- Compare rates from different lenders, including banks, credit unions, and online lenders.

- Look for lenders that specialize in auto loan refinancing and offer competitive rates.

Step 3: Apply for Refinancing

- Gather necessary documents, such as proof of income, current loan details, and identification.

- Submit your application to the selected lender and wait for approval.

Step 4: Review Loan Terms

- Once approved, review the new loan terms, including interest rate, monthly payments, and any fees.

- Make sure the new terms align with your financial goals and budget.

Step 5: Close the Old Loan and Start the New One

- Sign the new loan agreement with the lender and close out the old loan.

- Start making payments on the new loan according to the agreed-upon terms.

Tips for Finding the Best Refinancing Options

- Shop around and compare rates from multiple lenders before making a decision.

- Consider the impact of refinancing on your credit score and overall financial health.

- Negotiate with lenders to see if they can offer better terms based on your creditworthiness.

Potential Fees and Charges

- Watch out for any origination fees, prepayment penalties, or other charges associated with refinancing.

- Calculate the total cost of refinancing, including fees, to determine if it’s worth it in the long run.

Considerations When Choosing a Refinancing Option

When looking into auto loan refinancing options, there are several key factors to consider in order to make the best decision for your financial situation.

Comparing Interest Rates

- It is crucial to compare interest rates offered by different lenders when refinancing your auto loan. Lower interest rates can lead to significant savings over the life of the loan.

- By securing a lower interest rate through refinancing, you can potentially reduce your monthly payments and the total amount you pay in interest over time.

Additional Features to Look For

- Aside from interest rates, consider other features such as flexible repayment terms, no prepayment penalties, and the option to skip a payment in case of financial hardship.

- Some lenders may also offer perks like automatic payment discounts, loyalty discounts, or the ability to earn rewards for making on-time payments.

Impact on Overall Cost

- Refinancing can impact the overall cost of your loan by potentially lowering your monthly payments, reducing the total interest paid, and shortening the loan term.

- However, it’s important to carefully evaluate the terms of the new loan to ensure that the benefits of refinancing outweigh any associated fees or costs.