Diving into the world of calculating debt-to-income ratio, strap in for a wild ride filled with financial jargon and real-world examples. Get ready to learn the ins and outs of this crucial aspect of personal finance in a way that’s as cool as your favorite high school jam.

Explaining the nitty-gritty details of how debt-to-income ratio works and why it matters, this guide will have you navigating through the complexities of financial health like a pro.

Understanding Debt-to-Income Ratio

In personal finance, the debt-to-income ratio is a crucial metric that helps individuals understand their financial health by comparing the amount of debt they have to their overall income. This ratio is used by lenders to assess a borrower’s ability to manage monthly payments and repay debts on time.

Calculation of Debt-to-Income Ratio

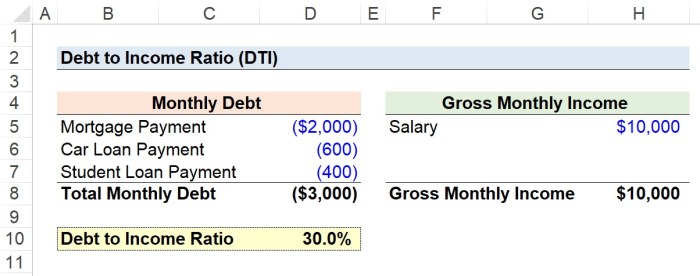

To calculate your debt-to-income ratio, you need to sum up all your monthly debt payments and divide that by your gross monthly income. The formula is as follows:

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

- For example, if your total monthly debt payments (including mortgage, car loans, credit card payments, and student loans) amount to $2,000 and your gross monthly income is $6,000, your debt-to-income ratio would be (2000 / 6000) x 100 = 33.33%.

- A lower debt-to-income ratio indicates that you have more disposable income and are in a better position to take on additional debt if needed.

Importance of Debt-to-Income Ratio

Understanding your debt-to-income ratio is crucial for maintaining financial stability. A high ratio could indicate that you are overextended and may struggle to make timely payments, leading to financial stress and potential credit issues.

- Lenders often use this ratio to determine your creditworthiness and decide whether to approve your loan application.

- By keeping your debt-to-income ratio within a healthy range, you can better manage your finances, save for the future, and avoid falling into a cycle of debt.

Ideal Debt-to-Income Ratio Range

The ideal debt-to-income ratio for individuals is typically below 36%. This means that your total monthly debt payments should not exceed 36% of your gross monthly income. By staying within this range, you can demonstrate to lenders that you have a good balance between debt obligations and income, making you a more attractive borrower.

Components of Debt-to-Income Ratio

When calculating your debt-to-income ratio, it’s important to understand the different components that make up both the debt side and the income side of the equation. Your debt-to-income ratio is a crucial factor that lenders consider when determining your eligibility for loans or credit.

Debt Side Components

- Credit Card Debt: The amount you owe on your credit cards.

- Loan Payments: Including car loans, student loans, and personal loans.

- Mortgage Payments: The monthly amount you pay towards your mortgage.

- Other Debts: Any other outstanding debts you may have, such as medical bills or personal debts.

Income Side Components

- Salary/Wages: Your regular income from your job or business.

- Additional Income: Any supplementary income sources, such as rental income or freelance work.

- Investment Income: Earnings from investments, dividends, or interest.

- Government Benefits: Social security, disability benefits, or any other government assistance.

Impact of Different Types of Debt

- High-Interest Debt: High-interest debt, like credit card debt, can significantly increase your debt-to-income ratio and make it harder to qualify for loans.

- Long-Term Debt: Long-term debts, such as a mortgage, may have a lower monthly payment but can still impact your ratio over the long term.

- Unsecured Debt: Unsecured debts, like personal loans, are typically viewed more negatively by lenders and can affect your ratio more than secured debts.

Impact of Various Income Sources

- Stable Income: Lenders prefer to see a stable and consistent income source to ensure you can meet your debt obligations.

- Variable Income: If you have a variable income, lenders may be more cautious as it can impact your ability to repay debts consistently.

- Multiple Income Streams: Having multiple sources of income can help improve your debt-to-income ratio and show financial stability.

Calculating Debt-to-Income Ratio

To calculate your debt-to-income ratio, follow these steps:

1. Add up all your monthly debt payments, including credit card payments, student loans, car loans, and mortgage payments.

2. Calculate your gross monthly income, which is your total income before taxes and other deductions.

3. Divide your total monthly debt payments by your gross monthly income.

4. Multiply the result by 100 to get a percentage, which is your debt-to-income ratio.

Formula for Manual Calculation

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Tools for Automation

- There are various online calculators available that can automate the process of calculating your debt-to-income ratio. These calculators can quickly provide you with your ratio by inputting your monthly debt payments and gross income.

- Some financial apps also offer features to track your debt-to-income ratio automatically, giving you a real-time view of your financial health.

Impact of Changes in Debt or Income

- If your debt increases, your debt-to-income ratio will also increase, indicating a higher risk of defaulting on payments.

- Conversely, if your income increases, your debt-to-income ratio will decrease, showing improved financial stability.

Importance of Debt-to-Income Ratio

Having a good understanding of your debt-to-income ratio is crucial when it comes to financial planning and making big decisions like taking out a loan. Lenders use this ratio to assess your ability to manage additional debt responsibly. Let’s dive into why this ratio holds such significance.

Why Lenders Consider Debt-to-Income Ratio

When applying for a loan, lenders look at your debt-to-income ratio to evaluate your financial health and determine if you can afford to take on more debt. This ratio gives them an idea of how much of your monthly income goes towards paying off debt, indicating how likely you are to default on a new loan.

How Debt-to-Income Ratio Influences Borrowing Ability

Your debt-to-income ratio directly impacts your ability to borrow money. A lower ratio signifies that you have more disposable income after paying off your debts, making you a less risky borrower. On the other hand, a high ratio indicates that a significant portion of your income is already committed to debt payments, potentially limiting your borrowing capacity.

Impact of Low or High Ratio on Financial Decisions

A low debt-to-income ratio can open up more financial opportunities for you, such as securing lower interest rates on loans or qualifying for higher loan amounts. Conversely, a high ratio may result in higher interest rates, stricter loan terms, or even rejection of loan applications, affecting your ability to make significant purchases or investments.

Real-Life Examples of Debt-to-Income Ratio in Financial Planning

For example, let’s say you have a debt-to-income ratio of 30%, which means 30% of your monthly income goes towards debt payments. If you want to buy a new car and your ratio is already on the higher side, lenders might offer you a loan with less favorable terms or deny your application altogether.