Credit score ranges explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding the basics to exploring the nuances, this guide is your ticket to mastering the world of credit scores.

Get ready to dive deep into the realm of credit scores, where we unravel the mysteries behind the numbers that can shape your financial future.

Understanding Credit Score Ranges

To understand credit score ranges, it’s essential to first grasp the concept of credit scores. A credit score is a numerical representation of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. Lenders, such as banks and credit card companies, use credit scores to assess the risk of lending money to a particular individual.

Credit Score Ranges

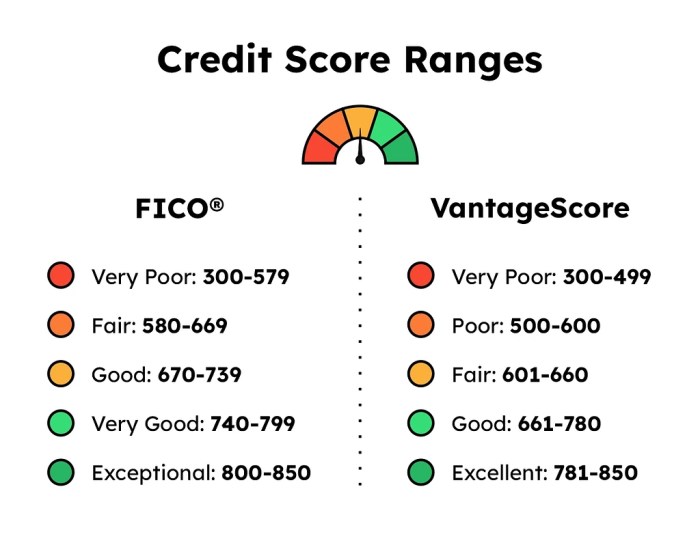

Credit score ranges are categories that credit bureaus use to classify individuals based on their credit scores. These ranges help lenders quickly evaluate an individual’s creditworthiness. The most common credit score ranges used by credit bureaus are:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

Factors Influencing Credit Scores

Having a good credit score is essential for financial health. Several key factors influence credit scores, impacting an individual’s ability to secure loans or credit cards. Understanding these factors is crucial for maintaining a healthy credit profile.

Payment History

Payment history is the most significant factor affecting credit scores. It accounts for about 35% of the total score. Lenders assess how consistently you pay bills on time and if you have any delinquent accounts. Missing payments or making late payments can significantly lower your credit score. Maintaining a strong payment history by paying bills on time is crucial for a good credit score.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. This factor makes up about 30% of your credit score. High credit utilization, where you are using a large percentage of your available credit, can negatively impact your score. It is recommended to keep your credit utilization below 30% to maintain a healthy credit score. Regularly monitoring and managing credit card balances can help improve credit utilization and overall credit health.

Range Breakdown: Poor Credit Scores

In this section, we will delve into the range of poor credit scores, what actions can lead to a poor credit score, and the consequences of having a poor credit score.

Definition of Poor Credit Scores

A poor credit score typically falls below a certain range, such as below 580 on the FICO scoring system. This indicates a higher risk for lenders when considering loan applications.

Actions Leading to Poor Credit Scores

- Missing payments on credit cards or loans

- Defaulting on loans

- Frequent late payments

- Maxing out credit cards

- Filing for bankruptcy

Consequences of Poor Credit Scores

- Higher interest rates on loans

- Difficulty getting approved for new credit

- Limited access to credit cards with favorable terms

- Difficulty renting an apartment or getting approved for a mortgage

- Impact on employment opportunities in certain industries

Range Breakdown: Fair Credit Scores

When it comes to fair credit scores, they typically fall within the range of 580 to 669, according to most credit scoring models. This range signifies that while your credit is not poor, there is still room for improvement to reach the good or excellent credit score levels.

Ways to Improve a Fair Credit Score

To improve a fair credit score, consider the following strategies:

- Pay your bills on time: Timely payments can positively impact your credit score over time.

- Reduce credit card balances: Lowering your credit card balances can help improve your credit utilization ratio, a key factor in determining your credit score.

- Avoid opening too many new accounts: Opening multiple accounts within a short period can lower your average account age and potentially impact your credit score.

- Regularly check your credit report: Monitoring your credit report can help you identify errors or fraudulent activity that may be affecting your credit score.

Benefits of Having a Fair Credit Score vs. Poor Credit Score

Having a fair credit score offers several advantages over having a poor credit score, including:

- Access to better interest rates: With a fair credit score, you may qualify for lower interest rates on loans and credit cards compared to someone with a poor credit score.

- Higher credit limits: Lenders may be more willing to extend higher credit limits to individuals with fair credit scores, allowing for greater financial flexibility.

- Moving closer to good credit: By actively working to improve your fair credit score, you are positioning yourself to eventually reach the good credit score range, opening up even more opportunities for favorable financial terms.

Range Breakdown: Good Credit Scores

Maintaining a good credit score is crucial for financial stability and access to better opportunities. A good credit score typically falls within the range of 670 to 739, according to the FICO scoring model.

Tips for Maintaining a Good Credit Score

- Pay your bills on time: Timely payments are one of the most important factors in determining your credit score.

- Keep your credit card balances low: Aim to use only a small portion of your available credit to show responsible credit utilization.

- Avoid opening too many new accounts: Opening multiple accounts in a short period can negatively impact your score.

- Regularly check your credit report: Monitoring your credit report can help you identify and address any errors or fraudulent activity.

Advantages of Having a Good Credit Score

- Lower interest rates: With a good credit score, you are more likely to qualify for lower interest rates on loans and credit cards.

- Higher credit limits: Lenders are more willing to offer higher credit limits to individuals with good credit scores.

- Access to better financial products: Good credit scores open doors to better financial products and services, such as premium credit cards and favorable loan terms.

- Improved chances of approval: Whether you’re applying for a loan, mortgage, or rental apartment, a good credit score increases your chances of approval.

Range Breakdown: Excellent Credit Scores

Achieving an excellent credit score is like reaching the top of the mountain in the world of credit. It typically falls within the range of 800 to 850, depending on the scoring model used by lenders.

How to Achieve and Sustain an Excellent Credit Score

To achieve and sustain an excellent credit score, you must demonstrate responsible credit management over time. This includes paying your bills on time, keeping your credit card balances low, and avoiding opening multiple new accounts within a short period.

- Make timely payments: Pay all your bills on time, every time.

- Keep credit card balances low: Aim to use no more than 30% of your available credit limit.

- Avoid opening new accounts frequently: Each new account can temporarily lower your average account age.

- Monitor your credit report: Regularly check your credit report for errors and fraudulent activity.

Perks and Advantages of Having an Excellent Credit Score

Having an excellent credit score comes with a multitude of benefits that can make your financial life much easier and more affordable.

- Access to the best interest rates: Lenders offer lower interest rates to borrowers with excellent credit scores.

- Higher credit limits: With an excellent credit score, you are more likely to qualify for higher credit limits on your credit cards.

- Approval for top-tier credit cards: You may be eligible for premium credit cards with exclusive perks and rewards.

- Better insurance rates: Some insurance companies offer lower rates to individuals with excellent credit scores.