Dive into the world of credit utilization ratio, a key factor in determining your financial health and creditworthiness. Let’s explore what it is, why it matters, and how you can improve it to boost your credit score.

Understanding the nuances of credit utilization ratio is crucial for anyone looking to take control of their credit profile and make smart financial decisions.

What is Credit Utilization Ratio?

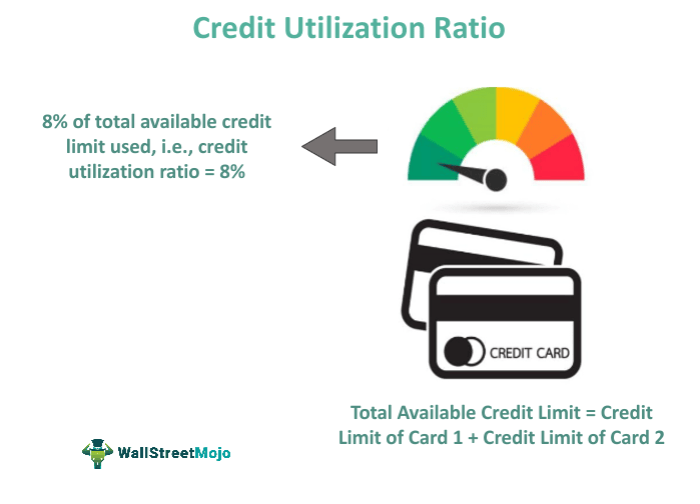

Credit utilization ratio is the percentage of your available credit that you are currently using. It is an important factor in determining your credit score and reflects how responsibly you manage your credit.

Calculation of Credit Utilization Ratio

To calculate your credit utilization ratio, simply divide your total credit card balances by your total credit card limits, and then multiply by 100 to get the percentage. For example, if you have a total credit card balance of $1,000 and a total credit limit of $5,000, your credit utilization ratio would be 20% ($1,000/$5,000 x 100).

Impact of Credit Utilization Ratio on Credit Scores

- A lower credit utilization ratio indicates that you are using your credit responsibly, which can positively impact your credit score.

- On the other hand, a higher credit utilization ratio can signal to lenders that you are relying too heavily on credit, which may negatively affect your credit score.

- Experts recommend keeping your credit utilization ratio below 30% to maintain a healthy credit score.

Importance of Credit Utilization Ratio

Maintaining a low credit utilization ratio is crucial for financial health as it directly impacts your credit score and overall creditworthiness. A high credit utilization ratio can signal to lenders that you may be overextended financially, leading to potential denials for new credit or higher interest rates on loans.

Relationship between Credit Utilization Ratio and Creditworthiness

- A low credit utilization ratio shows that you are effectively managing your credit and are not overly reliant on borrowed funds.

- Lenders prefer to see a credit utilization ratio of 30% or lower, as it indicates responsible credit usage.

- High credit utilization ratios can suggest financial instability and may lower your credit score.

- Improving your credit utilization ratio demonstrates financial discipline and can boost your creditworthiness over time.

Tips to Improve Credit Utilization Ratio

- Pay down existing credit card balances to lower your overall credit utilization ratio.

- Avoid closing unused credit accounts, as this can decrease your total available credit and increase your ratio.

- Request a credit limit increase on your existing credit cards to reduce your utilization ratio.

- Use credit responsibly and aim to keep your balances low relative to your credit limits.

Factors Influencing Credit Utilization Ratio

When it comes to credit utilization ratio, there are several factors that can have a significant impact on an individual’s financial standing. Understanding these factors is crucial for maintaining a healthy credit score.

Credit Limits and Outstanding Balances

One of the key factors that influence credit utilization ratio is the relationship between credit limits and outstanding balances. The credit utilization ratio is calculated by dividing the total amount of credit used by the total credit available. Therefore, the lower the outstanding balance in relation to the credit limit, the lower the credit utilization ratio will be. In general, it is recommended to keep the credit utilization ratio below 30% to maintain a good credit score.

Role of Credit Card Usage

Another important factor that affects credit utilization ratio is how credit cards are used. Using credit cards responsibly by making timely payments and avoiding maxing out the credit limit can help keep the credit utilization ratio low. It is essential to strike a balance between using credit cards for convenience and building a positive credit history while keeping the credit utilization ratio in check.

Managing Credit Utilization Ratio

Effective management of your credit utilization ratio is crucial for maintaining a healthy credit score. Here are some strategies to help you manage it wisely:

Impact of Closing Credit Accounts on Credit Utilization Ratio

When you close a credit account, it can impact your credit utilization ratio. Closing an account reduces your total available credit, which can lead to a higher utilization ratio if you carry balances on other cards. It’s important to consider this before closing any credit accounts.

Monitoring and Tracking Credit Utilization Ratio Regularly

Keeping a close eye on your credit utilization ratio is key to managing it effectively. You can monitor it by checking your credit card statements regularly and keeping track of your total credit limits and balances. Aim to keep your ratio below 30% to maintain a good credit score.