Get ready to dive into the world of debt repayment strategies with the debt avalanche vs snowball method showdown. Brace yourself for a comparison that will help you pick the best approach to tackle your debts like a boss.

In the following paragraphs, we’ll break down the Debt Avalanche and Snowball methods, compare their pros and cons, and equip you with the knowledge to make informed financial decisions.

Explain the Debt Avalanche method.

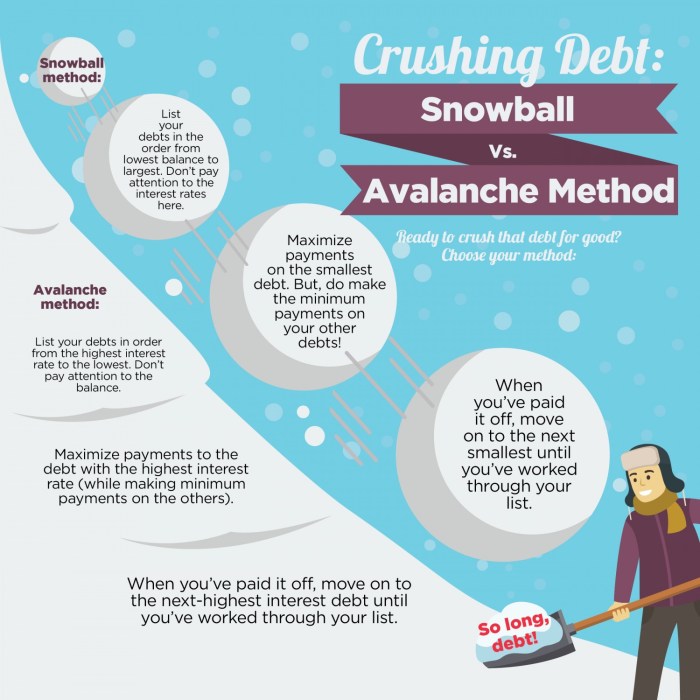

The Debt Avalanche method is a debt repayment strategy that focuses on paying off debts with the highest interest rates first, while making minimum payments on all other debts. This method aims to save money on interest payments in the long run and eliminate debt more efficiently.

How the Debt Avalanche method works

The Debt Avalanche method involves listing all debts from highest to lowest interest rates. You then allocate extra funds towards the debt with the highest interest rate while continuing to make minimum payments on the rest. Once the highest interest debt is paid off, you move on to the next highest interest debt, and so on.

- Identify debts with interest rates

- Make minimum payments on all debts

- Allocate extra funds towards the debt with the highest interest rate

- Continue this process until all debts are paid off

By focusing on high-interest debts first, the Debt Avalanche method saves you money in interest payments over time.

Example scenario of implementing the Debt Avalanche method

For instance, let’s say you have three debts:

– Credit Card A with a balance of $5,000 and an interest rate of 20%

– Personal Loan B with a balance of $8,000 and an interest rate of 12%

– Student Loan C with a balance of $10,000 and an interest rate of 6%

Using the Debt Avalanche method, you would prioritize paying off Credit Card A first, as it has the highest interest rate. Once that is paid off, you would move on to Personal Loan B and then Student Loan C. This strategy helps you save money on interest payments and pay off your debts more efficiently.

Explain the Snowball Method

The Snowball Method is a debt repayment strategy that involves paying off your debts from smallest to largest, regardless of interest rates.

Define the Snowball Method

The Snowball Method is a debt repayment approach where you focus on paying off your smallest debts first, then rolling the amount you were paying on that debt into the next smallest debt, and so on, creating a ‘snowball’ effect.

Describe how the Snowball Method works

When using the Snowball Method, you make minimum payments on all your debts except for the smallest one, which you attack with extra payments. Once the smallest debt is paid off, you move on to the next smallest debt, using the amount you were paying on the first debt, plus the minimum payment you were already making on the second debt. This method continues until all debts are paid off.

Provide an example scenario of implementing the Snowball Method

For example, let’s say you have three debts:

1. Credit card debt of $500 with a minimum payment of $50.

2. Student loan debt of $2,000 with a minimum payment of $100.

3. Car loan debt of $5,000 with a minimum payment of $200.

Using the Snowball Method, you would focus on paying off the credit card debt first by making extra payments on top of the $50 minimum payment. Once the credit card debt is paid off, you would then move on to the student loan debt, adding the $50 you were paying on the credit card to the $100 minimum payment for the student loan. This process continues until all debts are cleared, creating momentum like a snowball rolling down a hill.

Compare the Debt Avalanche and Snowball methods.

When it comes to tackling debt, two popular methods that individuals often consider are the Debt Avalanche and Snowball methods. Both approaches aim to help people pay off their debts efficiently, but they differ in terms of strategy and execution.

Key Differences Between Debt Avalanche and Snowball Methods

- The Debt Avalanche method focuses on paying off debts with the highest interest rates first, regardless of the balance. This approach saves money on interest payments over time.

- On the other hand, the Snowball method involves paying off debts starting with the smallest balance first, regardless of interest rates. This method provides a psychological boost as debts are eliminated quicker.

Advantages of Using the Debt Avalanche Method Over the Snowball Method

- By targeting debts with the highest interest rates first, the Debt Avalanche method helps individuals save money in the long run by reducing overall interest payments.

- Individuals using the Debt Avalanche method may pay off their debts faster compared to the Snowball method, especially if high-interest debts are prioritized.

Advantages of Using the Snowball Method Over the Debt Avalanche Method

- The Snowball method provides a sense of accomplishment and motivation as smaller debts are paid off sooner, giving individuals a psychological boost to continue their debt repayment journey.

- For individuals who may feel overwhelmed by their debt load, the Snowball method offers a more manageable approach by tackling smaller balances first, making the process feel less daunting.

Personal Finance Strategies.

When it comes to choosing the right debt repayment strategy based on individual financial situations, there are a few key tips to keep in mind. Factors such as the total amount of debt, interest rates, income level, and personal preferences all play a role in determining which method may work best for you. It’s important to carefully evaluate these factors before making a decision.

Factors to Consider

- Interest Rates: The Debt Avalanche method focuses on paying off debts with the highest interest rates first, potentially saving you more money in the long run. On the other hand, the Snowball method targets debts with the smallest balances regardless of interest rates, which can provide a sense of accomplishment by paying off debts quicker.

- Total Debt Amount: If you have multiple debts with varying balances, the Snowball method may be more appealing as it allows you to see progress sooner by paying off smaller debts first. However, if you have high-interest debts that are costing you more over time, the Debt Avalanche method might be more beneficial.

- Income Level: Consider your monthly income and budget constraints when choosing a repayment strategy. The Snowball method may provide more flexibility in the short term by freeing up cash flow sooner, while the Debt Avalanche method requires a more disciplined approach to paying off high-interest debts first.

- Personal Preferences: Some individuals may prefer the psychological boost of paying off smaller debts first with the Snowball method, while others may prioritize saving money on interest with the Debt Avalanche method. It’s important to choose a strategy that aligns with your financial goals and motivates you to stay on track.

Staying Motivated

- Set Clear Goals: Define specific debt repayment goals and track your progress regularly. Celebrate small victories along the way to stay motivated and focused on your financial journey.

- Visualize Success: Create visual reminders of your goals, such as a debt payoff tracker or vision board. Seeing your progress visually can help you stay motivated and committed to paying off debt.

- Stay Accountable: Consider sharing your debt repayment goals with a friend, family member, or financial advisor. Having someone to hold you accountable can provide additional support and encouragement during challenging times.

- Reward Yourself: Don’t forget to reward yourself for reaching milestones in your debt repayment journey. Treat yourself to a small indulgence or experience to celebrate your hard work and dedication.