Diving into the realm of debt reduction strategies, get ready to explore some savvy ways to tackle and conquer your debt. We’re about to break down the ins and outs of reducing debt, American high school hip style.

In the following paragraphs, we’ll unravel the mysteries behind various methods, techniques, and tips to help you pave your way to a debt-free future.

Overview of Debt Reduction Strategies

Debt reduction strategies are specific plans and actions individuals or organizations take to lower and eventually eliminate their debt. These strategies are crucial for regaining financial stability and achieving long-term financial goals.

It is important to have a plan for reducing debt because it helps individuals or organizations manage their financial obligations effectively. Without a clear strategy in place, debt can quickly spiral out of control, leading to financial stress and instability.

Benefits of Implementing Debt Reduction Strategies

- Lower Interest Payments: By reducing debt, individuals can decrease the amount of interest they pay over time, saving money in the long run.

- Improved Credit Score: Paying off debt in a timely manner can positively impact credit scores, making it easier to access credit at favorable terms in the future.

- Financial Freedom: Eliminating debt provides individuals with a sense of freedom and control over their finances, allowing them to focus on other financial goals and priorities.

- Reduced Stress: Living with high levels of debt can be emotionally draining. Implementing debt reduction strategies can help alleviate stress and improve overall well-being.

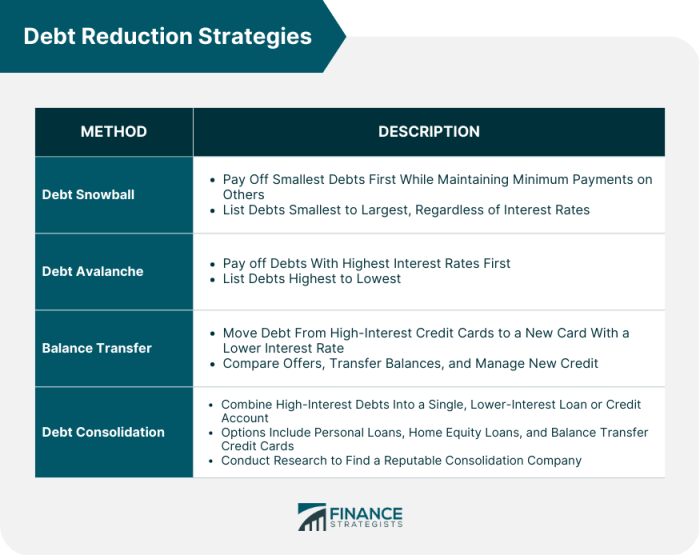

Common Debt Reduction Methods

When it comes to reducing debt, there are several popular methods that individuals can use to tackle their financial obligations. Each method has its own unique approach and benefits, so it’s important to understand how they work and their pros and cons before deciding which one is right for you.

The three main debt reduction methods that are commonly used include the snowball method, avalanche method, and debt consolidation. Let’s take a closer look at each one:

Snowball Method

The snowball method involves paying off your debts from smallest to largest, regardless of interest rate. This strategy allows you to build momentum by quickly eliminating smaller debts, which can motivate you to continue paying off larger debts. While the snowball method may not save you as much money on interest compared to the avalanche method, it can be effective for those who need a psychological boost from seeing progress sooner.

Avalanche Method

The avalanche method focuses on paying off debts with the highest interest rates first, while making minimum payments on all other debts. By targeting high-interest debts, you can save money on interest in the long run and pay off your debts more efficiently. This method is best suited for individuals who are looking to minimize the total amount of interest paid over time.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or line of credit with a lower interest rate. This can make it easier to manage your payments and potentially reduce the overall amount of interest you pay. However, it’s important to be cautious with debt consolidation, as it may not always be the best option depending on your individual financial situation.

Overall, each debt reduction method has its own advantages and drawbacks, so it’s essential to carefully consider your goals and financial circumstances before choosing the right strategy for you.

Budgeting Techniques for Debt Reduction

Budgeting plays a crucial role in debt reduction as it helps individuals track their income and expenses, identify areas where they can cut back, and allocate funds towards paying off debts. By creating a budget that aligns with debt reduction goals, individuals can effectively manage their finances and make progress towards becoming debt-free.

Zero-Based Budgeting

Zero-based budgeting is a budgeting technique where income minus expenses equals zero. Every dollar earned is allocated towards expenses, savings, or debt repayment. This method ensures that all income is accounted for and helps individuals prioritize debt reduction by assigning a specific amount to debt payments each month.

50/30/20 Rule

The 50/30/20 rule is a budgeting technique that suggests allocating 50% of income towards needs, 30% towards wants, and 20% towards savings and debt repayment. By following this rule, individuals can ensure that a significant portion of their income is directed towards debt reduction while still allowing for some flexibility in spending.

Envelope System

The envelope system involves dividing cash into different envelopes labeled for various expense categories such as groceries, entertainment, and debt repayment. Once the money in an envelope is spent, individuals cannot spend more in that category until the next budgeting period. This method helps individuals control their spending and stay on track with debt reduction goals.

Increasing Income to Accelerate Debt Payoff

Increasing your income is a great way to speed up the process of paying off your debts. By having more money coming in, you can allocate extra funds towards your debt repayment, helping you become debt-free sooner.

Side Hustles for Extra Income

- Consider starting a side hustle, such as dog walking, tutoring, or freelance writing, to bring in additional income.

- Use online platforms like Upwork or Fiverr to offer your skills and services to a wider audience.

- Explore the gig economy by driving for Uber or delivering food for services like DoorDash or Postmates.

Selling Unused Items

- Go through your belongings and identify items you no longer need or use, then sell them online on platforms like eBay or Facebook Marketplace.

- Consider hosting a garage sale or participating in local flea markets to quickly sell unused items and generate extra cash.

- Utilize apps like Poshmark for selling clothes or OfferUp for various items to reach a larger audience.

Importance of Allocating Extra Income to Debt Repayment

- Ensure that any additional income earned from side hustles or selling items is directly allocated towards paying off your debts.

- By prioritizing debt repayment with your extra income, you can reduce the total interest paid over time and achieve financial freedom sooner.

- Creating a specific budget for your additional income can help you track progress and stay motivated in your debt payoff journey.