Yo, check it out! We’re diving into the world of debt-to-income ratio explained. Get ready to learn the ins and outs of this financial concept in a way that’s gonna keep you hooked from start to finish.

So, let’s break it down for you – what exactly is debt-to-income ratio and why is it so important?

What is Debt-to-Income Ratio?

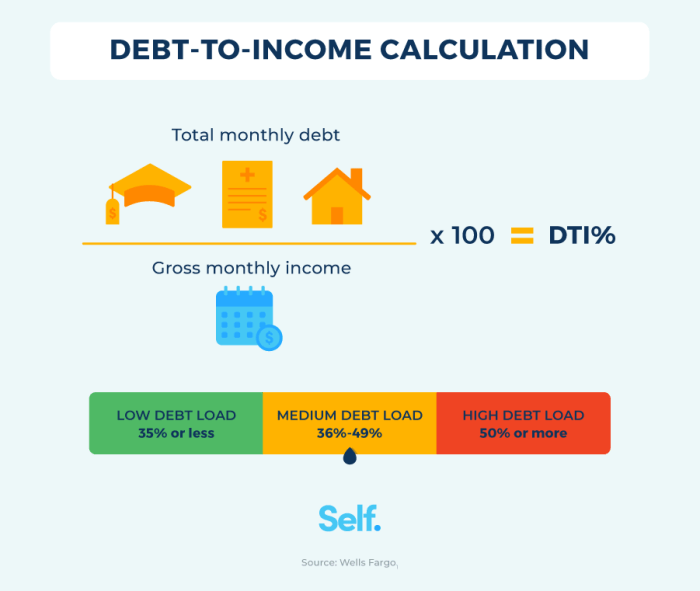

Debt-to-Income Ratio, often abbreviated as DTI, is a financial metric that compares the amount of debt a person or household has to their overall income. This ratio is commonly used by lenders to determine an individual’s ability to manage monthly payments and repay debts.

When calculating the Debt-to-Income Ratio, the total monthly debt payments are divided by the total gross monthly income. The result is then multiplied by 100 to get a percentage. This percentage indicates how much of a person’s income is used to repay debts.

Types of Debt and Income in the Ratio

- Debt: Debt includes all fixed monthly payments such as mortgage payments, car loans, student loans, credit card payments, and any other outstanding debts that require regular payments.

- Income: Income refers to the total gross earnings of an individual before taxes and deductions. This can include salaries, wages, bonuses, alimony, rental income, and any other sources of income.

Importance of Debt-to-Income Ratio

Having a good understanding of your debt-to-income ratio is crucial when it comes to managing your finances and applying for loans. Lenders carefully consider this ratio to assess your financial health and determine your ability to handle additional debt responsibly. Let’s dive deeper into why debt-to-income ratio is so important.

Why Lenders Consider Debt-to-Income Ratio

Lenders use the debt-to-income ratio as a key factor in evaluating your creditworthiness. This ratio gives them insight into how much of your monthly income goes towards paying off debts, such as credit card bills, student loans, and mortgage payments. By analyzing this ratio, lenders can gauge your ability to manage your current debts and take on additional financial obligations.

How Debt-to-Income Ratio Influences Loan Approval

Your debt-to-income ratio plays a significant role in the loan approval process. Lenders typically have thresholds for acceptable debt-to-income ratios, and exceeding these limits can make it harder to qualify for a loan. A lower ratio indicates that you have more disposable income available to cover new loan payments, making you a less risky borrower in the eyes of lenders.

Ideal Debt-to-Income Ratio for Financial Health

The ideal debt-to-income ratio for financial health is generally considered to be 28% or lower. This means that your total monthly debt payments should not exceed 28% of your gross monthly income. Maintaining a low debt-to-income ratio demonstrates to lenders that you are financially stable and capable of managing your debts responsibly.

Interpreting Debt-to-Income Ratio

When it comes to interpreting debt-to-income ratio, it’s crucial to understand how this number can impact your overall financial stability. A high ratio can signal potential financial distress and affect your ability to borrow money or secure favorable interest rates.

Impact of a High Ratio on Financial Stability

Having a high debt-to-income ratio means that a significant portion of your income goes towards paying off debts. This can leave you with less disposable income for everyday expenses, emergency savings, or investments. Additionally, a high ratio may make it challenging to qualify for new loans or credit cards, as lenders may see you as a higher financial risk.

To improve a high debt-to-income ratio, consider the following strategies:

- Increase Income: Look for opportunities to boost your income through a side hustle, a raise at work, or passive income streams.

- Reduce Debt: Focus on paying off high-interest debts first and create a budget to allocate more towards debt repayment.

- Refinance Loans: Explore options to refinance loans at lower interest rates to lower monthly payments.

- Cut Expenses: Identify areas where you can cut back on spending to free up more money for debt payments.

Thresholds for Debt-to-Income Ratios

Different financial situations may have varying thresholds for debt-to-income ratios. For example, mortgage lenders typically look for a debt-to-income ratio of around 36% or lower, while some personal finance experts recommend aiming for a ratio of 28% or less. Understanding these thresholds can help you gauge where you stand and work towards a healthier financial position.

Factors Influencing Debt-to-Income Ratio

When it comes to your debt-to-income ratio, several factors can play a significant role in determining where you stand financially. Understanding these factors is crucial for managing your finances effectively.

Income Level

Your income level is a key factor that directly impacts your debt-to-income ratio. As your income increases, your ability to handle more debt also increases. Conversely, a decrease in income can lead to a higher debt-to-income ratio, making it more challenging to manage your debts.

Debt Level

The amount of debt you carry is another crucial factor influencing your debt-to-income ratio. The more debt you have, the higher your ratio will be. This means that taking on additional debt, such as loans or credit card balances, can significantly impact your overall financial health.

Interest Rates

Interest rates play a vital role in determining your debt-to-income ratio. Higher interest rates on your debts can increase the amount you owe over time, leading to a higher ratio. It’s essential to consider the impact of interest rates when managing your debts to ensure they remain at a manageable level.