Yo, check it – we’re diving deep into the world of dividend payout ratios. Get ready for a wild ride filled with financial knowledge and insights that’ll blow your mind.

Let’s break down what dividend payout ratios are, how they’re calculated, and why investors are all about them.

Definition of Dividend Payout Ratios

Dividend payout ratios are a financial metric used by investors to evaluate how much of a company’s earnings are being distributed to shareholders in the form of dividends. This ratio helps assess the sustainability and efficiency of a company’s dividend policy.

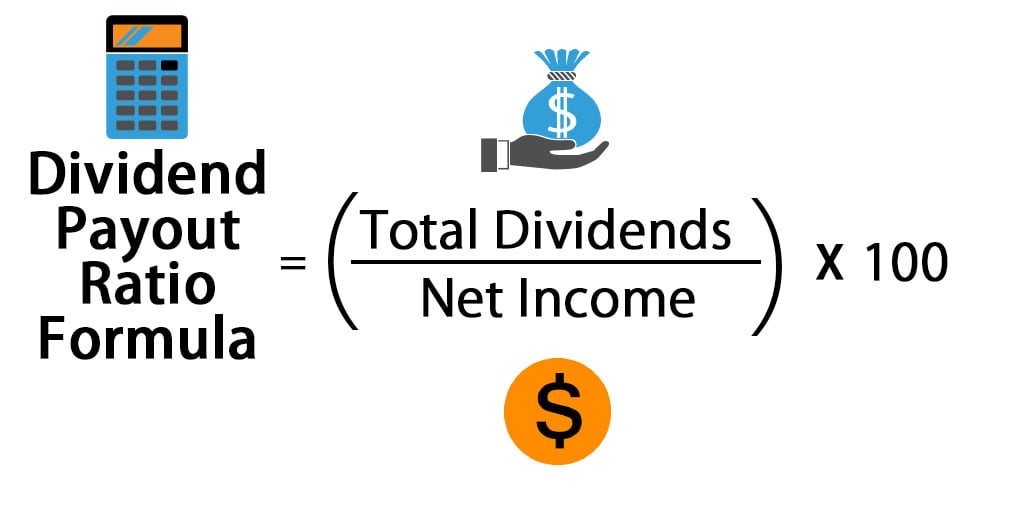

Calculation of Dividend Payout Ratios

The dividend payout ratio is calculated by dividing the total dividends paid out by the company by its net income. The formula is represented as:

Dividend Payout Ratio = Dividends Paid / Net Income

Importance of Dividend Payout Ratios for Investors

- Investors can use dividend payout ratios to determine if a company is generating enough earnings to sustain its dividend payments.

- A high dividend payout ratio may indicate that a company is returning a large portion of its profits to shareholders, leaving less for reinvestment in the business.

- On the other hand, a low dividend payout ratio might suggest that a company is retaining more earnings for growth opportunities.

Types of Dividend Payout Ratios

When it comes to analyzing a company’s dividend distribution, different types of ratios play a crucial role in providing valuable insights. Let’s delve into the key differences between dividend payout ratio, dividend yield, and dividend coverage ratio.

Dividend Payout Ratio

The dividend payout ratio is a measure of the proportion of earnings paid out as dividends to shareholders. It is calculated by dividing the total dividends by the net income of the company. A high payout ratio indicates that a company is distributing a large portion of its profits to shareholders.

Dividend Yield

Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its stock price. It is calculated by dividing the annual dividend per share by the stock price per share. A high dividend yield may indicate that a company is offering attractive returns to investors through dividends.

Dividend Coverage Ratio

The dividend coverage ratio measures a company’s ability to cover its dividend payments with its earnings. It is calculated by dividing the earnings per share by the dividend per share. A ratio greater than 1 indicates that the company has enough earnings to cover its dividend payments.

Factors Influencing Dividend Payout Ratios

When it comes to dividend payout ratios, several key factors can influence how much a company pays out to its shareholders. Let’s dive into some of the main influencers that impact these ratios.

Company Profitability

Company profitability plays a significant role in determining dividend payout ratios. Companies with higher profits tend to have more resources available to distribute dividends to their shareholders. A strong financial performance often leads to a higher payout ratio, as the company can afford to share a larger portion of its earnings with investors.

Growth Prospects

The growth prospects of a company can also affect its dividend payout ratio. Companies that are experiencing rapid growth may choose to reinvest a larger portion of their earnings back into the business to fund expansion opportunities. As a result, they may opt for a lower payout ratio to retain more cash for future growth initiatives.

Industry Trends

Industry trends can have a significant impact on dividend payout ratios. Companies operating in industries that are experiencing growth and stability may feel more confident in paying out higher dividends to shareholders. On the other hand, companies in volatile or declining industries may adopt a more conservative approach and opt for a lower payout ratio to protect against future uncertainties.

Management Decisions and Market Conditions

Management decisions and market conditions also play a crucial role in influencing dividend payout ratios. The leadership team’s strategy and objectives can shape the company’s dividend policy, determining whether to increase, maintain, or decrease dividend payments. Moreover, external factors such as economic conditions, interest rates, and regulatory changes can impact the company’s decision-making process regarding dividend payouts.

Importance of Dividend Payout Ratios

Investors and companies alike rely on dividend payout ratios to gauge financial health and performance. For investors, these ratios provide insights into the stability and potential growth of a company. On the other hand, companies use dividend payout ratios to evaluate their ability to sustain dividend payments while maintaining profitability.

Financial Stability and Growth Potential

- Dividend payout ratios can indicate a company’s financial stability. A consistent and reasonable payout ratio suggests that a company is generating enough profits to reward shareholders without jeopardizing its operations.

- Moreover, high dividend payout ratios can signal growth potential. Companies with a history of increasing dividend payouts tend to attract investors looking for long-term investment opportunities.

- Conversely, low or decreasing dividend payout ratios may raise concerns about a company’s financial health and growth prospects, potentially leading to a decline in investor confidence.

Impact on Investor Decisions and Company Performance

- Changes in dividend payout ratios can significantly impact investor decisions. For example, a sudden increase in dividend payout ratios might attract income-seeking investors seeking higher returns, while a decrease could signal financial challenges.

- Companies that maintain or grow their dividend payout ratios over time often experience a positive impact on their stock prices. This increase in shareholder value reflects investor confidence in the company’s stability and growth potential.

- Conversely, companies that fail to adjust dividend payout ratios in line with their financial performance may face scrutiny from investors and analysts, potentially leading to a decrease in stock value.