When it comes to home equity loans vs lines of credit, buckle up for a ride through the world of financial jargon and decision-making. Get ready to dive into the nitty-gritty details that will help you navigate these options like a pro.

In this guide, we’ll break down the differences between home equity loans and lines of credit, shedding light on which option might be the best fit for your financial needs.

Introduction to Home Equity Loans and Lines of Credit

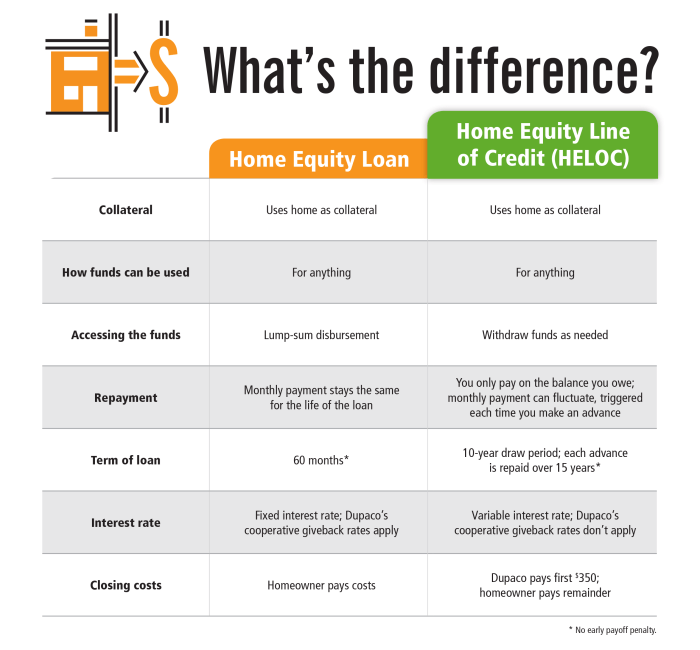

Home equity loans are loans that allow homeowners to borrow money using the equity they have built up in their homes as collateral. These loans typically have fixed interest rates and are received in a lump sum payment.

Home equity lines of credit (HELOC), on the other hand, are a form of revolving credit in which homeowners can borrow money multiple times, up to a certain limit, using their home equity as collateral. HELOCs often have variable interest rates and allow borrowers to withdraw funds as needed.

Differences between Home Equity Loans and Lines of Credit

- Payment structure: Home equity loans have fixed monthly payments, while HELOCs have variable payments based on the amount borrowed.

- Interest rates: Home equity loans typically have fixed interest rates, while HELOCs have variable rates that can change over time.

- Access to funds: Home equity loans provide a lump sum payment upfront, while HELOCs allow borrowers to withdraw funds as needed up to a certain limit.

- Usage of funds: Home equity loans are often used for large, one-time expenses like home renovations, while HELOCs are used for ongoing expenses or projects.

Purpose and Usage

When it comes to home equity loans and lines of credit, understanding their purpose and best usage is key to making informed financial decisions. Let’s dive into the common purposes for taking out a home equity loan and the scenarios where a home equity line of credit shines.

Common Purposes for Home Equity Loans

- Home Renovations: Many homeowners use a home equity loan to finance major renovations or home improvement projects, increasing the value of their property.

- Debt Consolidation: Consolidating high-interest debt through a home equity loan can lower overall interest rates and simplify monthly payments.

- Education Expenses: Funding higher education costs for yourself or your children is another popular use of home equity loans.

Scenarios for Home Equity Line of Credit (HELOC)

- Variable Expenses: For ongoing or fluctuating expenses like medical bills or emergencies, a HELOC provides flexibility with a revolving line of credit.

- Short-Term Cash Needs: When you need quick access to funds for a short period, a HELOC can be a cost-effective solution compared to other types of loans.

- Home Repairs: Using a HELOC for unexpected home repairs allows homeowners to address issues promptly without draining their savings.

Examples of Effective Usage

For example, if you’re planning a kitchen remodel that will increase your home’s value, a home equity loan with a fixed rate may be the best option to finance the project. On the other hand, if you anticipate multiple expenses over time, like funding your child’s college tuition or covering medical bills, a HELOC can provide the flexibility to draw funds as needed and repay over time.

Interest Rates and Terms

When it comes to home equity loans and lines of credit, understanding the interest rates and terms is crucial in determining the overall cost and flexibility of these financial products.

Interest Rates Comparison

- Home Equity Loans: Typically come with fixed interest rates, providing stability in monthly payments over the life of the loan.

- Lines of Credit: Usually have variable interest rates, meaning payments can fluctuate based on market conditions.

Repayment Terms

- Home Equity Loans: Offer a structured repayment plan with fixed monthly payments spread out over a set term, typically ranging from 5 to 30 years.

- Lines of Credit: Provide more flexibility in repayment, allowing borrowers to access funds as needed and make interest-only payments during the draw period, followed by a repayment period with principal and interest payments.

Impact on Cost and Flexibility

-

Fixed interest rates on home equity loans can provide predictability and stability in budgeting, while variable rates on lines of credit can lead to uncertainty in monthly payments.

-

The structured repayment terms of home equity loans may be more suitable for borrowers looking to pay off a specific expense over time, while the flexibility of lines of credit can be advantageous for ongoing or unpredictable expenses.

Accessing Funds

When it comes to accessing funds with a home equity loan, the process is quite straightforward. Once your loan is approved, you will receive a lump sum of money upfront, which you can use for various purposes such as home renovations, debt consolidation, or other expenses.

Home Equity Line of Credit (HELOC)

With a home equity line of credit (HELOC), accessing funds works differently. Instead of receiving a lump sum, you are given a line of credit that you can draw from as needed. This gives you the flexibility to borrow only what you need when you need it, similar to a credit card.

Differences in Accessing Funds

– Home Equity Loan: Lump sum payment upfront.

– HELOC: Line of credit for borrowing as needed.

– Home Equity Loan: Fixed amount determined at the start.

– HELOC: Revolving credit line with a limit.

– Home Equity Loan: Repayment begins immediately.

– HELOC: Minimum payments during draw period, followed by repayment period.

Risk and Benefits

When considering home equity loans and lines of credit, it’s important to weigh the risks and benefits of each option.

Risks of Home Equity Loans

Home equity loans come with the risk of losing your home if you are unable to make the required payments. Additionally, if the value of your home decreases, you could end up owing more than your home is worth.

Advantages of Home Equity Line of Credit

One major advantage of choosing a home equity line of credit is the flexibility it offers. With a line of credit, you can borrow only what you need, when you need it, and you only pay interest on the amount you use.

Comparison of Risks and Benefits

While home equity loans provide a lump sum of money upfront and typically have fixed interest rates, they carry the risk of potentially losing your home. On the other hand, home equity lines of credit offer flexibility and lower interest rates, but the variable rates could increase over time.

Eligibility and Requirements

When it comes to eligibility and requirements for home equity loans and lines of credit, there are some key factors to consider. Let’s dive into what it takes to qualify for these financial options.

Eligibility for Home Equity Loan

To be eligible for a home equity loan, you typically need to have a good credit score, a stable income, and a certain amount of equity built up in your home. Lenders will also look at your debt-to-income ratio and may have specific requirements regarding the loan-to-value ratio.

Requirements for Home Equity Line of Credit

Qualifying for a home equity line of credit (HELOC) is similar to a home equity loan in terms of credit score, income stability, and equity in your home. However, with a HELOC, you may need a higher credit score and a lower debt-to-income ratio compared to a home equity loan. Lenders also consider your ability to repay based on your income and overall financial situation.

Notable Differences

One notable difference in eligibility between a home equity loan and a HELOC is the way you access funds. With a home equity loan, you receive a lump sum upfront, while a HELOC provides a revolving line of credit that you can draw from as needed. This difference can impact the lender’s requirements and eligibility criteria, as they assess the risk differently for each type of loan.