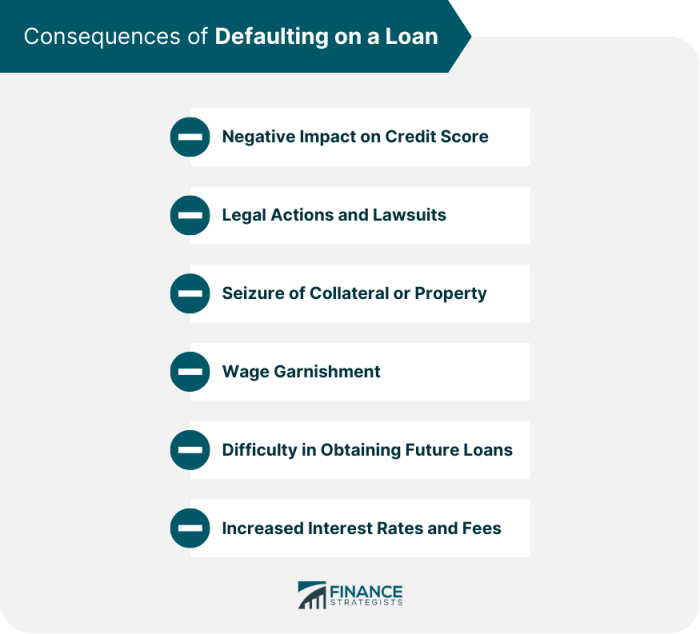

Diving into the world of loan default consequences, we uncover the legal, financial, and credit score impacts that individuals may face when unable to repay their loans. From potential legal actions to tips on rebuilding credit, this discussion sheds light on the aftermath of defaulting on loans.

As we delve deeper into the repercussions of loan default, we unveil the hidden costs and strategies for navigating through financial hardship.

Legal Consequences

When an individual defaults on a loan, there are serious legal implications that can arise. Lenders have the right to take legal action to recover the amount owed, which can lead to various consequences for the defaulter.

Legal Actions by Lenders

- Lawsuit: Lenders can file a lawsuit against the defaulter to obtain a court judgment for the outstanding debt.

- Foreclosure: In the case of defaulting on a mortgage loan, the lender may initiate foreclosure proceedings to repossess the property.

- Wage Garnishment: Lenders can seek a court order to garnish the defaulter’s wages to repay the debt.

Role of Debt Collection Agencies

Debt collection agencies are often hired by lenders to pursue repayment from defaulters. These agencies engage in activities such as making collection calls, sending notices, and negotiating payment plans on behalf of the lender.

Impact on Credit Scores

Defaulting on a loan can have a significant negative impact on an individual’s credit score. A default is typically reported to credit bureaus, leading to a lower credit score and making it harder to secure future credit or loans.

Financial Impact

Loan default can have severe consequences on an individual’s financial stability, leading to a series of negative repercussions. When a borrower fails to make timely payments on a loan, it can result in a significant loss of assets and financial turmoil.

Loss of Assets

Defaulting on a loan can lead to the loss of assets that were used as collateral for the loan. For example, in the case of a mortgage loan, the lender may foreclose on the property to recover the outstanding debt. Similarly, defaulting on a car loan can result in the repossession of the vehicle.

Repercussions on Different Types of Loans

The financial repercussions of defaulting on different types of loans can vary. For instance, defaulting on a personal loan may lead to a damaged credit score and difficulty in obtaining future credit. On the other hand, defaulting on a student loan can result in wage garnishment, tax refund offset, or even the inability to renew a professional license.

Additional Fees and Penalties

In addition to the loss of assets, borrowers who default on a loan may also incur additional fees and penalties. These can include late fees, collection costs, and legal fees. For example, credit card companies may charge high interest rates and penalty fees for missed payments, further exacerbating the borrower’s financial burden.

Credit Score Impact

When it comes to defaulting on a loan, the impact on your credit score can be significant and lasting. Your credit score is a reflection of how responsible you are with credit and how likely you are to repay debts. Here’s how loan default can affect your credit score in the short and long term.

Short-term Impact

After defaulting on a loan, your credit score will likely take a hit. The missed payments will be reported to the credit bureaus, causing your score to drop. This can make it harder to qualify for new credit or loans in the short term.

Long-term Impact

The negative impact of a loan default can linger on your credit report for years. Even after you’ve paid off the debt, the missed payments and default status can stay on your report for up to seven years. This can make it difficult to rebuild your credit and regain a good score.

Rebuilding Credit After Default

To start rebuilding your credit after defaulting on a loan, focus on making on-time payments on any current debts. Consider getting a secured credit card or a credit-builder loan to demonstrate responsible credit use. Monitor your credit report regularly to check for any errors and work on improving your credit habits.

Impact on Future Loan Applications

A lower credit score resulting from a loan default can have a significant impact on future loan applications. Lenders may view you as high-risk and offer you higher interest rates or deny your application altogether. It’s important to work on improving your credit score to increase your chances of approval and better loan terms.

Alternative Solutions

When facing difficulties in repaying loans, it’s essential to explore alternative options to avoid defaulting on payments. Debt restructuring or consolidation can be potential solutions to help manage the financial burden.

Debt Restructuring and Consolidation

Debt restructuring involves renegotiating the terms of your loan with the lender to make repayments more manageable. This may include extending the loan term, reducing interest rates, or changing the repayment schedule.

- Consolidation, on the other hand, combines multiple debts into a single loan with a lower interest rate. This can simplify payments and potentially lower monthly expenses.

- By consolidating your debts, you may be able to secure a more affordable repayment plan that fits your current financial situation.

Negotiating with Lenders

It’s crucial to communicate with your lenders if you’re experiencing financial hardship. You can discuss modifying loan terms to make payments more manageable and avoid defaulting.

- Explain your situation honestly and provide any documentation to support your financial struggles.

- Ask about options for temporary payment reductions, interest rate adjustments, or forbearance to help you stay current on your loan.

Seeking Professional Financial Advice

When dealing with loan repayment challenges, seeking advice from a financial professional can provide valuable insights and guidance.

- A financial advisor can help you assess your financial situation, explore alternative solutions, and create a plan to address your debt effectively.

- They can also offer strategies to improve your financial stability and avoid future loan repayment difficulties.