Get ready to dive into the world of loan repayment schedules, where financial planning meets strategy in a captivating journey. Brace yourself for a rollercoaster of insights and practical tips to navigate the realm of structured repayments.

Let’s explore the key components, types, and effective strategies behind loan repayment schedules that can shape your financial future.

Importance of Loan Repayment Schedules

Repaying loans is a crucial financial responsibility, and having a structured repayment schedule can make a significant difference in managing this obligation effectively. By adhering to a repayment schedule, borrowers can better plan their finances, avoid missed payments, and prevent falling into a cycle of debt.

Managing Finances Effectively

Loan repayment schedules provide borrowers with a clear roadmap of when payments are due, how much is owed, and for how long. This level of transparency allows individuals to budget accordingly, ensuring that they allocate the necessary funds each month to meet their repayment obligations. By having a set schedule in place, borrowers can avoid the stress of uncertainty and better plan for their financial future.

Improving Credit Scores

Adhering to a repayment schedule not only helps borrowers stay on track with their payments but also has a positive impact on their credit scores. Consistently making on-time payments as per the schedule demonstrates financial responsibility and can boost one’s creditworthiness. A good credit score opens up opportunities for better loan terms, lower interest rates, and improved financial stability in the long run.

Components of Loan Repayment Schedules

When it comes to loan repayment schedules, there are several key elements that play a crucial role in determining how much you need to pay back and when. Understanding these components is essential for managing your finances effectively and staying on top of your loan obligations.

Interest Rates

Interest rates are a fundamental aspect of any loan repayment schedule. The rate at which you are charged interest will directly impact the total amount you need to repay over the life of the loan. Typically, loans with higher interest rates will result in higher monthly payments and a larger overall repayment amount. It’s important to carefully consider the interest rate when taking out a loan and understand how it will affect your repayment schedule.

Loan Term

The loan term refers to the length of time you have to repay the loan in full. Shorter loan terms usually come with higher monthly payments but lower overall interest costs, while longer loan terms often have lower monthly payments but higher total interest expenses. The loan term plays a significant role in shaping the structure of your repayment schedule and determining how much you will pay each month. It’s essential to choose a loan term that aligns with your financial goals and budget.

Types of Loan Repayment Schedules

When it comes to loan repayment schedules, there are different types that borrowers can choose from based on their financial situation and preferences. Two common types are fixed repayment schedules and variable repayment schedules.

Fixed Repayment Schedules vs. Variable Repayment Schedules

- Fixed Repayment Schedules: With a fixed repayment schedule, the borrower makes equal payments over the life of the loan. This provides predictability and stability in budgeting since the payment amount remains constant.

- Variable Repayment Schedules: On the other hand, variable repayment schedules have fluctuating payment amounts. These payments can change based on factors like interest rate changes, which can lead to uncertainty for borrowers.

Amortizing vs. Interest-Only Repayment Schedules

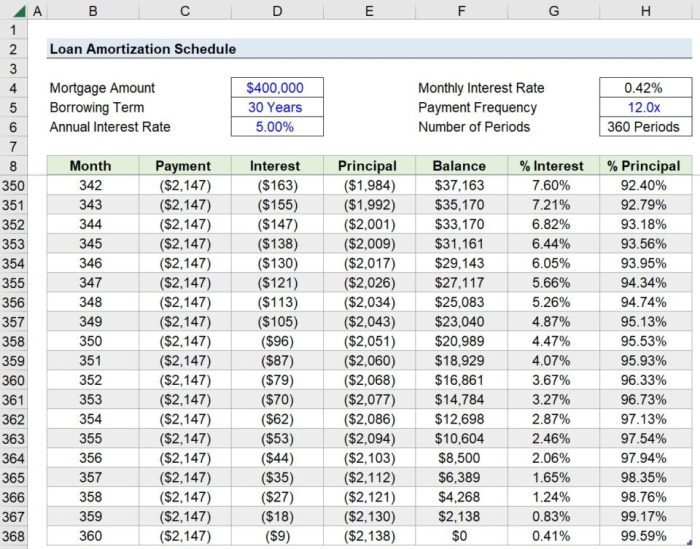

- Amortizing Repayment Schedules: In an amortizing repayment schedule, each payment covers both the interest and a portion of the principal amount. Over time, the borrower reduces the outstanding balance until the loan is fully paid off.

- Interest-Only Repayment Schedules: With an interest-only repayment schedule, the borrower only pays the interest on the loan for a certain period. The principal amount remains the same, and a separate plan is needed to repay the principal later.

Examples of Different Types of Repayment Schedules

| Loan Product | Repayment Schedule |

|---|---|

| 30-year Fixed-Rate Mortgage | Amortizing Repayment Schedule |

| Adjustable-Rate Mortgage (ARM) | Variable Repayment Schedule |

| Interest-Only Personal Loan | Interest-Only Repayment Schedule |

Creating an Effective Loan Repayment Schedule

When it comes to paying back that borrowed cash, you gotta have a solid plan in place. Let’s break it down on how to create a repayment schedule that works for you.

Steps to Create a Personalized Repayment Schedule

- Calculate Your Total Loan Amount: First things first, figure out exactly how much you owe. Take into account any interest that may have accrued.

- Assess Your Financial Situation: Look at your income, expenses, and any other debts you have. Determine how much you can realistically afford to put towards loan repayment each month.

- Choose a Repayment Plan: Decide whether you want to go for a standard repayment plan, income-driven plan, or another option that suits your financial goals.

- Set Up Automatic Payments: Make it easy on yourself by setting up automatic payments to ensure you never miss a due date.

Tools and Resources for Setting Up a Repayment Plan

There are plenty of online calculators and budgeting apps that can help you work out a repayment schedule that fits your budget.

Tips for Adjusting Your Repayment Schedule

- Communicate with Your Lender: If you’re facing financial difficulties, reach out to your lender to discuss possible options for adjusting your repayment plan.

- Look for Deferment or Forbearance Options: In case of emergencies or unexpected financial changes, inquire about deferment or forbearance to temporarily pause or reduce your payments.

- Reassess Your Budget Regularly: Stay on top of your finances by regularly reviewing your budget and making adjustments as needed to stay on track with your repayment schedule.