Yo, we’re diving into the world of managing debt efficiently, where financial savvy meets street smarts. Get ready to learn how to handle your cash flow like a boss and keep those debts in check.

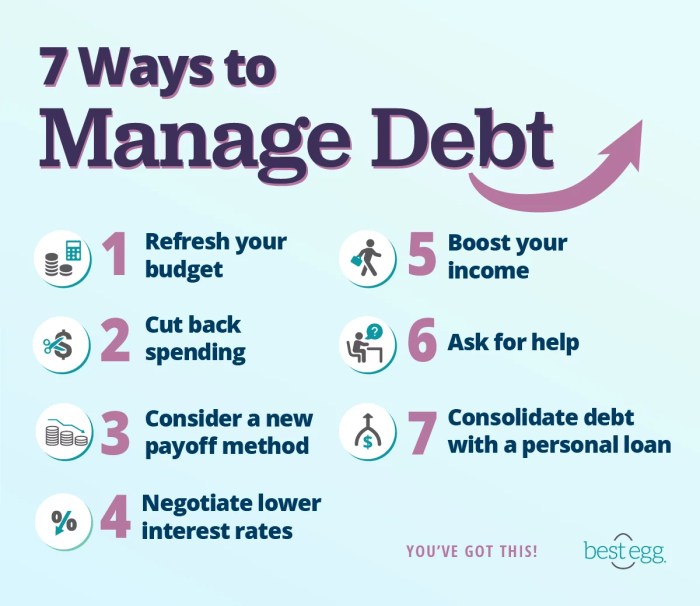

From understanding debt management to creating a killer budget, we’ve got all the tips and tricks to help you stay on top of your financial game.

Understanding Debt Management

Debt management is the process of handling and organizing debts in a way that allows individuals to repay them efficiently while also maintaining financial stability. It is crucial for individuals to manage their debts effectively to avoid falling into financial distress.

Good Debt vs. Bad Debt

- Good Debt: Good debt is typically used to invest in assets that have the potential to increase in value over time, such as student loans or mortgages.

- Bad Debt: Bad debt refers to debts incurred for purchases that do not appreciate in value or generate income, such as credit card debt used for unnecessary expenses.

Types of Debt

- Student Loans: Debt taken out to fund education expenses.

- Mortgages: Loans used to purchase real estate properties.

- Auto Loans: Financing for purchasing vehicles.

- Credit Card Debt: Balances accumulated through credit card spending.

Consequences of Mismanaging Debt

Mismanaging debt can lead to a range of negative consequences, including:

– Accumulation of high-interest payments

– Damage to credit score and history

– Legal actions such as wage garnishment or repossession

Creating a Budget

Creating a budget is essential for managing debt efficiently. It helps you track your expenses, prioritize payments, and stay on top of your financial goals.

Steps to Create a Comprehensive Budget

- List all sources of income: Include all your streams of income, such as salary, freelance work, or rental income.

- Identify fixed expenses: Write down all your fixed expenses like rent, utilities, and loan payments.

- Track variable expenses: Keep track of your variable expenses like groceries, dining out, and entertainment.

- Set financial goals: Determine short-term and long-term financial goals to guide your budgeting decisions.

- Create a budget plan: Allocate your income to cover all expenses, savings, and debt payments.

Tips on Tracking Expenses Effectively

- Use budgeting apps: Apps like Mint or YNAB can help track your expenses and categorize them automatically.

- Keep receipts: Save receipts and review them regularly to understand your spending patterns.

- Check your bank statements: Monitor your bank statements to catch any unauthorized charges or overspending.

- Review regularly: Set aside time each week to review your budget and adjust as needed.

How Budgeting Helps in Managing Debt Efficiently

- Prioritize debt payments: Budgeting allows you to allocate a portion of your income towards paying off debt each month.

- Reduce unnecessary expenses: By tracking your spending, you can identify areas where you can cut back to allocate more towards debt repayment.

- Stay organized: A budget helps you stay organized with your finances, ensuring you don’t miss any payments or incur additional fees.

Tools or Apps for Budgeting

- Mint: A popular budgeting app that tracks your spending, sets financial goals, and provides insights into your financial habits.

- YNAB (You Need A Budget): Focuses on giving every dollar a job, helping you prioritize expenses and savings goals.

- Personal Capital: Offers budgeting tools along with investment tracking and retirement planning features.

- PocketGuard: Helps you track your spending and identify opportunities to save more effectively.

Developing a Repayment Strategy

When it comes to managing debt efficiently, developing a solid repayment strategy is crucial. By prioritizing debts and negotiating lower interest rates, you can accelerate the repayment process and achieve financial freedom sooner.

Snowball Method vs. Avalanche Method

- The snowball method involves paying off debts from smallest to largest, regardless of interest rates. This can provide a sense of accomplishment and motivation as you eliminate smaller debts first.

- On the other hand, the avalanche method focuses on paying off debts with the highest interest rates first. While it may take longer to see progress, this method can save you money on interest in the long run.

Prioritizing Debts for Accelerated Repayment

- By prioritizing high-interest debts, you can reduce the overall amount you pay in interest over time. This can help you pay off debts faster and save money in the process.

- Consider consolidating high-interest debts or transferring balances to lower interest rate accounts to streamline your repayment process.

Negotiating Lower Interest Rates

- Reach out to your creditors to negotiate lower interest rates, especially if you have a history of on-time payments or financial hardship. Lower interest rates can help you pay off debts more quickly and save money in the long run.

- Be prepared to explain your situation and provide evidence of your financial hardship, such as income statements or budget plans, to support your request for lower interest rates.

Successful Debt Repayment Stories

“I was able to pay off over $20,000 in credit card debt by following a strict budget and using the avalanche method to prioritize high-interest debts first. Negotiating lower interest rates with my creditors also helped me save money and accelerate the repayment process.”

“After years of struggling with student loan debt, I finally paid off my loans by consolidating them into a lower interest rate account and making extra payments whenever possible. It took dedication and discipline, but I am now debt-free and able to focus on building my savings.”

Seeking Professional Help

Seeking help from credit counselors or financial advisors is appropriate when you feel overwhelmed by debt and need expert guidance to create a solid repayment plan. These professionals can provide personalized advice based on your financial situation and help you navigate through the complexities of debt management.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can make it easier to manage your payments and potentially reduce the overall amount you owe. However, it’s crucial to carefully assess the terms and costs associated with debt consolidation to ensure it’s the right solution for your financial goals.

Debt Settlement

Debt settlement is a process where you negotiate with creditors to pay off your debts for less than what you owe. While this can help you get out of debt faster, it may have a negative impact on your credit score and result in additional fees. It’s essential to weigh the pros and cons of debt settlement before pursuing this option.

Reputable Debt Management Services

Finding reputable debt management services is crucial to ensure you receive trustworthy and effective assistance with your debt. Look for accredited organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) to connect with certified professionals who can help you develop a sustainable debt repayment plan.