Step into the world of managing revolving credit where financial savvy meets practical tips. Get ready to dive deep into the realm of responsible credit management and maximizing benefits with an edgy twist.

Let’s break down the essentials of understanding and mastering the art of revolving credit management.

Understanding Revolving Credit

Rev up your financial knowledge with a deep dive into revolving credit – a key player in the credit game.

Revving up your credit game with revolving credit can be a game-changer. Understanding how it works is crucial to mastering your financial strategy.

What is Revolving Credit?

Revving up your credit game with revolving credit can be a game-changer. Understanding how it works is crucial to mastering your financial strategy.

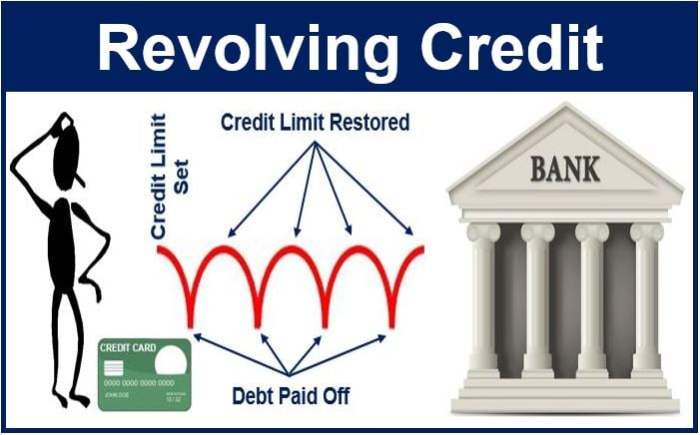

Rev up your knowledge on how revolving credit works! Unlike installment credit where you borrow a fixed amount and pay it off in set installments, revolving credit gives you a credit limit you can borrow from as needed. You can choose to pay off the full balance or carry a balance from month to month, making it a flexible option for managing your expenses.

Revolving Credit vs. Installment Credit

Let’s break it down: Revolving credit is like cruising down the financial highway with a flexible credit limit you can borrow from and repay over time. On the other hand, installment credit is more like taking a one-time loan for a fixed amount that you pay off in set installments. Both have their pros and cons, so choose wisely based on your financial goals.

Examples of Revolving Credit Accounts

Rev up your knowledge with these common types of revolving credit accounts:

- Credit Cards: The OG of revolving credit, allowing you to make purchases up to your credit limit and pay it off over time.

- Home Equity Line of Credit (HELOC): Tap into your home’s equity with a revolving line of credit for expenses like home renovations or emergencies.

- Retail Store Cards: Get that retail therapy fix with store-specific credit cards that offer revolving credit for your shopping sprees.

- Personal Lines of Credit: A flexible borrowing option that gives you access to funds as needed, similar to a credit card but without the plastic.

Managing Revolving Credit Responsibly

When it comes to managing revolving credit responsibly, there are key factors to keep in mind to maintain a healthy credit score and financial well-being.

Importance of Making Timely Payments

One of the most crucial aspects of managing revolving credit is making timely payments on your credit card bills. Late payments can negatively impact your credit score and result in additional fees and interest charges.

Credit Utilization Ratio Impact on Credit Score

Your credit utilization ratio plays a significant role in determining your credit score. It is calculated by dividing your total credit card balances by your total credit limits. Keeping this ratio low, ideally below 30%, can help improve your credit score.

Strategies to Lower Credit Utilization

- Avoid maxing out your credit cards and try to keep your balances low.

- Consider asking for a credit limit increase to decrease your credit utilization ratio.

- Pay off balances in full each month to maintain a low credit utilization ratio.

Potential Risks of Revolving Credit and Mitigation

While revolving credit can offer flexibility, it also comes with risks if not managed properly. Some potential risks include accumulating high-interest debt, damaging your credit score, and falling into a cycle of debt. To mitigate these risks, it is important to create a budget, only charge what you can afford to pay off, and monitor your credit card statements regularly.

Maximizing Benefits of Revolving Credit

When it comes to using revolving credit, there are various ways to maximize the benefits and make the most out of your credit cards. From building credit history to earning rewards, responsible credit card usage can open up a world of opportunities for savvy consumers. Let’s dive into some strategies for maximizing the benefits of revolving credit.

Building Credit History with Revolving Credit

One of the key benefits of using revolving credit is the opportunity to build a positive credit history. By making timely payments and keeping your credit utilization low, you can demonstrate to lenders that you are a responsible borrower. This can help improve your credit score over time, making it easier to qualify for loans and other financial products in the future.

Earning Rewards through Responsible Credit Card Usage

Many credit card companies offer rewards programs that allow cardholders to earn points, cash back, or other perks for their spending. By using your credit card for everyday purchases and paying off your balance in full each month, you can take advantage of these rewards without falling into debt. It’s important to choose a rewards program that aligns with your spending habits and financial goals to maximize the benefits.

Maximizing Benefits with Credit Card Churning

Credit card churning is a strategy used by some consumers to maximize the benefits of credit card rewards. This involves opening multiple credit cards to take advantage of sign-up bonuses, introductory offers, and other incentives. While credit card churning can yield significant rewards, it’s essential to carefully manage your credit accounts and avoid damaging your credit score in the process.

Comparing Different Types of Rewards

Credit card companies offer a wide range of rewards, including travel points, cash back, statement credits, and discounts on purchases. It’s important to compare the terms and benefits of different rewards programs to find the best fit for your lifestyle and financial needs. Some cards may offer higher rewards rates in specific categories, while others may have annual fees or spending requirements to consider.

Tips for Effective Revolving Credit Management

When it comes to managing revolving credit, there are several important tips to keep in mind to stay on top of your finances and avoid falling into debt traps. Here are some key strategies to help you effectively manage your revolving credit accounts:

Create a Budget to Manage Revolving Credit

One of the first steps in effectively managing your revolving credit is to create a budget. By outlining your monthly income and expenses, you can better track your spending and ensure that you are not overspending on your credit cards. Make sure to allocate a portion of your budget towards paying off your credit card balances to avoid accumulating high-interest debt.

Monitor Credit Card Statements Regularly

It’s essential to regularly monitor your credit card statements to track your spending, identify any unauthorized charges, and ensure that all transactions are accurate. By staying on top of your statements, you can address any issues promptly and prevent fraudulent activity on your accounts.

Avoid Falling into the Debt Trap

To avoid falling into the debt trap with revolving credit, it’s crucial to only charge what you can afford to pay off each month. Avoid carrying a balance on your credit cards whenever possible, as high-interest rates can quickly accumulate debt. Make sure to prioritize paying off your balances in full to maintain a healthy credit utilization ratio.

Set Up Automatic Payments for Credit Cards

Setting up automatic payments for your credit cards can help ensure that you never miss a payment deadline. By scheduling automatic payments for at least the minimum amount due each month, you can avoid late fees, penalties, and negative impacts on your credit score. Just be sure to monitor your accounts regularly to confirm that payments are being processed correctly.