As mortgage payment calculator takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Planning to take out a loan for a new home? Understanding how a mortgage payment calculator works can be the key to making informed financial decisions. Dive into this guide to unlock the secrets of mortgage payments and budget planning.

Overview of Mortgage Payment Calculator

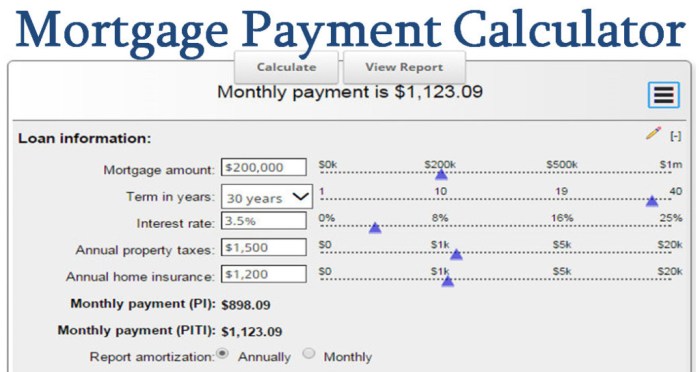

A mortgage payment calculator is a tool that helps individuals estimate their monthly mortgage payments based on variables such as loan amount, interest rate, and loan term. It works by taking these inputs and calculating the total amount to be paid each month, including principal and interest.

Importance of Using a Mortgage Payment Calculator

Using a mortgage payment calculator before obtaining a loan is crucial as it allows borrowers to understand how much they can afford to borrow, what their monthly payments will be, and how different loan terms can impact their finances. It helps individuals make informed decisions and avoid taking on more debt than they can comfortably repay.

Popular Mortgage Payment Calculators Online

- Zillow Mortgage Calculator: This calculator provides detailed breakdowns of monthly payments, including principal, interest, taxes, and insurance.

- Bankrate Mortgage Calculator: Bankrate offers a simple calculator that allows users to input loan details and get an estimate of their monthly payments.

- NerdWallet Mortgage Calculator: NerdWallet’s calculator helps users compare different loan options and understand the long-term costs of each.

Components of a Mortgage Payment Calculator

When using a mortgage payment calculator, there are several key components that play a crucial role in determining the monthly payment amount. These components include the loan amount, interest rate, and loan term.

Loan Amount

The loan amount is the total amount of money borrowed from a lender to purchase a home. This is a significant factor in calculating the mortgage payment because it directly impacts the size of the monthly payments. The higher the loan amount, the higher the monthly payment will be.

Interest Rate

The interest rate is the percentage charged by the lender for borrowing the money. It is applied to the loan amount to determine the interest portion of the monthly payment. A higher interest rate will result in a higher monthly payment, while a lower interest rate will result in a lower monthly payment.

Loan Term

The loan term is the length of time over which the loan will be repaid. Common loan terms are 15, 20, or 30 years. The loan term affects the monthly payment because it determines how many payments will be made over the life of the loan. A shorter loan term will result in higher monthly payments but less interest paid over the life of the loan, while a longer loan term will result in lower monthly payments but more interest paid.

Additional features or options commonly found in mortgage payment calculators include the ability to input property taxes, homeowners insurance, and private mortgage insurance (PMI) costs. These additional costs can be factored into the calculation to provide a more accurate estimate of the total monthly payment. Some calculators may also allow users to input extra payments or adjust the interest rate to see how it affects the overall payment amount.

Benefits of Using a Mortgage Payment Calculator

Using a mortgage payment calculator can provide numerous advantages for potential homebuyers. It helps in financial planning, budgeting, and making informed decisions regarding mortgage options.

Financial Planning and Budgeting

Utilizing a mortgage payment calculator allows individuals to estimate their monthly mortgage payments based on different loan amounts, interest rates, and terms. This helps in creating a realistic budget and understanding how much home they can afford without overextending financially.

- By inputting different scenarios, such as varying down payments or loan terms, users can assess the impact on their monthly payments and overall budget.

- Understanding the financial implications of different mortgage options helps individuals make informed decisions that align with their long-term financial goals.

Real-Life Scenarios

Consider a scenario where a couple is looking to buy their first home. By using a mortgage payment calculator, they can compare the monthly payments for different loan amounts and interest rates. This enables them to determine the most suitable mortgage option that fits their budget and financial situation.

“The ability to visualize and analyze different mortgage scenarios empowers individuals to make sound financial decisions when purchasing a home.”

Tips for Effective Use of a Mortgage Payment Calculator

To make the most out of a mortgage payment calculator, it is crucial to input accurate information. This ensures that the results generated are reliable and helpful in your financial planning. Avoiding common mistakes and understanding how to interpret the results can further enhance the effectiveness of using a mortgage payment calculator.

Inputting Accurate Information

- Enter the correct loan amount: Make sure to input the exact amount you are borrowing to get accurate payment estimates.

- Provide the interest rate: Input the correct interest rate to reflect the actual cost of borrowing.

- Include loan term: Enter the duration of the loan in years to calculate the total amount paid over time accurately.

- Consider additional costs: Factor in property taxes, insurance, and any other fees to get a comprehensive payment estimate.

Avoiding Common Mistakes

- Avoid rounding errors: Input precise numbers to prevent miscalculations in the payment estimates.

- Double-check the interest rate: Ensure the interest rate entered matches the current rate to avoid inaccurate results.

- Don’t forget additional costs: Including all associated fees ensures a more realistic payment calculation.

- Review the results: Double-check the generated payment amount to confirm it aligns with your expectations.

Interpreting Results

- Monthly payment breakdown: Understand how much of your monthly payment goes towards principal, interest, taxes, and insurance.

- Total cost of the loan: Analyze the total amount you will pay over the loan term to assess affordability.

- Comparison tool: Use the calculator to compare different loan options and understand their financial implications.