Diving into the world of credit scores is like embarking on a journey to financial enlightenment. From unraveling the mysteries behind creditworthiness to deciphering the impact of these numbers on your financial well-being, this guide is your gateway to mastering the art of credit scores. Get ready to decode the language of lenders and pave the way to a brighter financial future.

As we delve deeper, you’ll uncover the key components that make up your credit score and how each piece fits into the larger puzzle of your financial health.

Importance of Credit Scores

Credit scores are a big deal when it comes to your financial health. They reflect your creditworthiness and how responsible you are with managing your finances.

Impact on Loan Approvals and Interest Rates

Your credit score can make or break your chances of getting approved for a loan. Lenders use this score to determine the level of risk you pose as a borrower. A higher credit score can lead to faster approvals and lower interest rates, saving you money in the long run.

- For example, if you have a high credit score, you may qualify for a mortgage with a lower interest rate, ultimately reducing the amount you pay over the life of the loan.

- On the flip side, a low credit score can result in loan denials or higher interest rates, costing you more money in the form of higher monthly payments or additional fees.

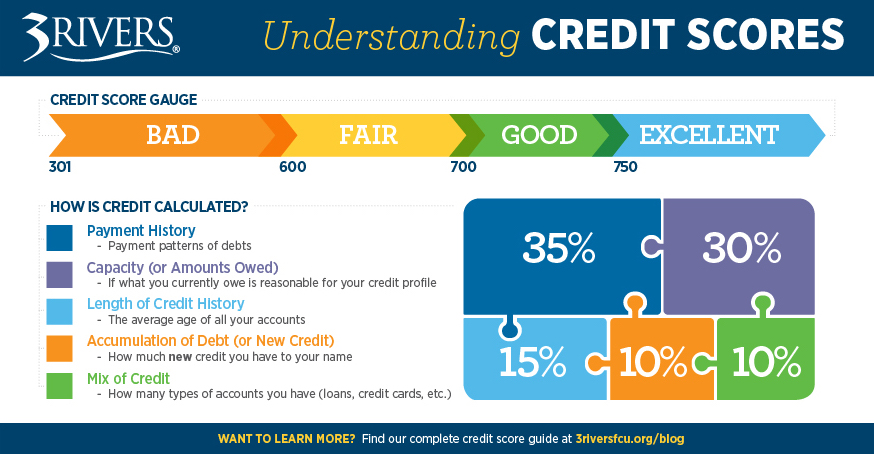

Factors Affecting Credit Scores

When it comes to credit scores, there are several key factors that can have a significant impact on your overall score. Understanding these factors is crucial for maintaining a healthy credit profile.

Payment History

Your payment history is one of the most critical factors that influence your credit score. This includes whether you make payments on time, any late payments, or missed payments. A history of on-time payments can positively impact your credit score, while late or missed payments can have a negative effect.

Credit Utilization

Credit utilization refers to the amount of credit you are currently using compared to the total amount of credit available to you. High credit utilization, where you are using a large percentage of your available credit, can negatively impact your credit score. It is generally recommended to keep your credit utilization below 30% to maintain a good credit score.

Length of Credit History

The length of your credit history also plays a role in determining your credit score. A longer credit history can demonstrate your ability to manage credit over time, which can positively impact your score. On the other hand, a short credit history may limit the data available to calculate your score.

New Credit Inquiries

Every time you apply for new credit, a hard inquiry is placed on your credit report. Multiple inquiries within a short period can signal to lenders that you are taking on too much new credit, which can negatively impact your credit score. It’s essential to be mindful of how often you apply for new credit.

Credit Mix

Having a mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. Lenders like to see that you can manage various types of credit responsibly. However, it’s important to only take on credit that you need and can afford to repay.

Understanding Credit Score Ranges

Credit scores typically fall within certain ranges, including poor, fair, good, and excellent. Each range signifies a different level of creditworthiness, affecting your ability to borrow money and access credit. It’s important to understand what each range means and how you can improve your credit score to move from one range to another.

Poor Credit Score

A poor credit score usually falls below 580. This range signifies a high credit risk to lenders, making it challenging to qualify for loans or credit cards. It may result in higher interest rates and limited credit options.

Fair Credit Score

A fair credit score typically ranges from 580 to 669. While it’s an improvement from poor credit, it still may lead to higher interest rates and fewer credit opportunities. It’s essential to work on raising your score to access better credit terms.

Good Credit Score

A good credit score falls between 670 and 739. This range indicates a lower credit risk to lenders, increasing your chances of approval for loans and credit cards. You may qualify for better interest rates and higher credit limits with a good credit score.

Excellent Credit Score

An excellent credit score is typically above 740. This range showcases a strong credit history and responsible financial behavior, making you an attractive borrower to lenders. You can enjoy the best interest rates, superior credit terms, and access to premium credit products with an excellent credit score.

Tips to Improve Your Credit Score

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low to maintain a healthy credit utilization ratio.

- Avoid opening multiple new credit accounts in a short period to prevent inquiries that can lower your score.

- Regularly check your credit report for errors and dispute any inaccuracies to ensure an accurate reflection of your credit history.

- Consider using credit-building tools like secured credit cards or becoming an authorized user on someone else’s account to boost your score.

Improving Credit Scores

To improve your credit score, consider strategies like paying bills on time and reducing debt. By implementing these practices consistently, individuals can work towards enhancing their creditworthiness.

Timely Bill Payments

- Set up automatic payments or reminders to ensure bills are paid on time.

- Even one late payment can negatively impact your credit score, so prioritize timely payments.

- Consistent on-time payments show responsibility and can help boost your credit score over time.

Debt Reduction

- Create a budget to allocate funds towards paying off existing debt.

- Focus on paying down high-interest debt first to reduce overall debt burden.

- Consider debt consolidation options to streamline payments and potentially lower interest rates.

Timeline for Improvement

Improvements in credit scores can vary based on individual circumstances. Generally, consistent positive credit behaviors can lead to gradual score increases over several months to a year.

Success Stories

- John increased his credit score by 100 points in a year by paying bills on time and keeping credit card balances low.

- Sarah saw a significant improvement in her credit score within six months by aggressively paying off her outstanding debts.

- Michael utilized a credit repair service and diligently followed their recommendations, resulting in a noticeable increase in his credit score over time.

Monitoring and Maintaining Credit Scores

Regularly monitoring your credit score is crucial to staying informed about your financial health and catching any errors or suspicious activities early on. This proactive approach can help you maintain a good credit score and prevent any negative impacts on your financial well-being.

Checking Credit Scores for Free

- Utilize free credit score websites: Websites like Credit Karma, Credit Sesame, and AnnualCreditReport.com offer free access to your credit score.

- Monitor your credit card statements: Many credit card companies now provide your credit score for free on your monthly statements.

Frequency of Checking

- Check your credit score at least once a month to stay on top of any changes or discrepancies.

- Before applying for a major loan or credit card, ensure your credit score is in good shape by checking it a few months in advance.

Tips for Maintaining a Healthy Credit Score

- Pay your bills on time: Timely payments are a key factor in maintaining a good credit score.

- Keep your credit utilization low: Aim to use only a small portion of your available credit to show responsible credit management.

- Avoid opening too many new accounts: Opening multiple accounts in a short period can negatively impact your credit score.

- Regularly review your credit report: Look for any errors or signs of identity theft that could harm your credit score.