Buckle up, because we’re diving deep into the world of FICO scores. From unraveling the mystery behind these three little letters to uncovering the secrets of financial health, this journey promises to be both enlightening and empowering.

Let’s kick things off by breaking down the basics of FICO scores and why they hold the key to your financial future.

Introduction to FICO Scores

FICO scores are like your financial report card, telling lenders how likely you are to repay a loan. They play a crucial role in determining whether you qualify for credit and what interest rates you’ll get.

Calculation of FICO Scores

FICO scores are calculated based on five key factors:

- Your payment history, which shows if you pay your bills on time.

- The amount of debt you owe compared to your available credit, known as credit utilization.

- The length of your credit history, including how long your accounts have been open.

- Your credit mix, which looks at the types of credit accounts you have, like credit cards or loans.

- New credit accounts and recent credit inquiries, which can impact your score.

Factors Influencing FICO Scores

- Payment history: Making payments on time is crucial for a good score.

- Credit utilization: Keeping your credit card balances low relative to your credit limits can boost your score.

- Length of credit history: Having a longer credit history can be beneficial.

- Credit mix: Having a diverse mix of credit accounts can show you can manage different types of credit responsibly.

- New credit: Opening multiple new accounts in a short period can negatively impact your score.

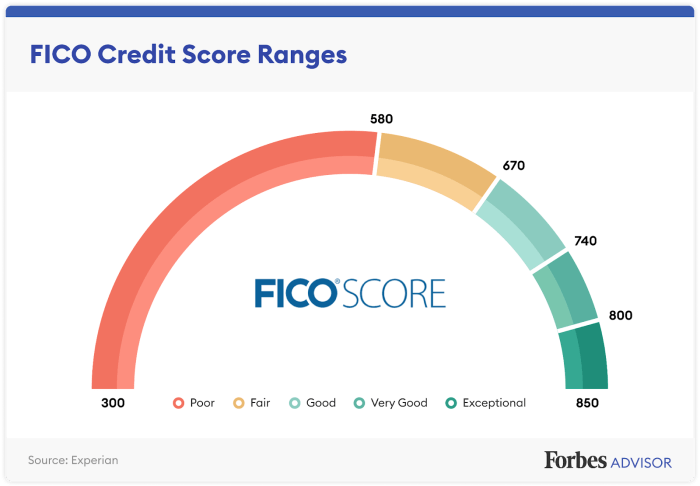

Understanding FICO Score Range

When it comes to FICO scores, understanding the range is crucial as it determines your creditworthiness and financial health. FICO scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Let’s dive deeper into the different score ranges and their implications.

Excellent (800-850)

- Individuals with FICO scores in this range are considered low-risk borrowers by lenders.

- They are likely to qualify for the best interest rates and loan terms.

- Having an excellent credit score can lead to easier approval for credit cards, mortgages, and other loans.

Good (670-799)

- Borrowers with scores in this range are still considered low to moderate risk.

- They may not receive the best interest rates but are generally eligible for most loans.

- Maintaining a good credit score is important for financial stability and access to credit.

Fair (580-669)

- Individuals in this range are considered moderate to high-risk borrowers.

- They may face challenges in getting approved for loans or credit cards.

- Improving a fair credit score can open up more financial opportunities in the future.

Poor (300-579)

- Borrowers with scores in this range are considered high-risk by lenders.

- They may struggle to get approved for credit or loans.

- Improving a poor credit score is essential for rebuilding credit and gaining financial stability.

Lenders interpret FICO score ranges to assess an individual’s credit risk and determine the likelihood of timely repayment of debts. A higher credit score indicates lower risk, while a lower score suggests higher risk.

Improving FICO Scores

Improving your FICO score is crucial for better financial opportunities. By following certain strategies and maintaining good practices, you can enhance your creditworthiness and access favorable terms on loans and credit cards.

Strategies for Improving Low FICO Scores

- Pay your bills on time: Late payments can significantly impact your FICO score. Make sure to pay all your bills by the due date to avoid negative marks on your credit report.

- Reduce your credit utilization: Aim to keep your credit card balances low relative to your credit limits. High credit utilization can signal financial distress to lenders.

- Check your credit report regularly: Monitor your credit report for errors or fraudulent activity that could harm your FICO score. Dispute any inaccuracies to ensure your report reflects your true credit history.

- Diversify your credit mix: Having a mix of credit accounts, such as credit cards, a mortgage, and a car loan, can demonstrate responsible credit management and boost your FICO score.

- Avoid opening too many new accounts: Opening multiple new credit accounts within a short period can lower your average account age and indicate financial instability.

Tips on Maintaining a Good FICO Score

- Set up payment reminders: Missing payments can harm your FICO score, so consider setting up automatic payments or reminders to ensure timely payments.

- Keep old accounts open: Closing old credit accounts can reduce your available credit and shorten your credit history, potentially lowering your FICO score.

- Limit credit inquiries: Applying for multiple new credit accounts can result in hard inquiries, which may negatively impact your FICO score. Be mindful of how often you apply for credit.

Impact of Various Financial Activities on FICO Scores

- Payment history: Accounts for the largest portion of your FICO score. Consistently paying bills on time can significantly boost your score.

- Credit utilization: The amount of credit you’re using compared to your total available credit. Keeping this ratio low can have a positive impact on your FICO score.

- Length of credit history: Having a longer credit history can demonstrate your experience in managing credit responsibly, which can benefit your FICO score.

- New credit accounts: Opening multiple new credit accounts in a short period can lower your average account age and potentially lower your FICO score.

- Credit mix: Having a diverse mix of credit accounts, such as credit cards, mortgages, and loans, can showcase your ability to manage different types of credit responsibly.

Importance of FICO Scores

Having a good FICO score is essential for maintaining healthy financial well-being. Your FICO score is a numerical representation of your creditworthiness, indicating to lenders how reliable you are in repaying borrowed money. It plays a crucial role in various financial decisions, impacting loan approvals, interest rates, and even job opportunities.

Impact on Loan Approvals and Interest Rates

When you apply for a loan, lenders use your FICO score to assess the risk of lending you money. A higher FICO score increases your chances of loan approval, as it demonstrates your ability to manage credit responsibly. Additionally, a higher score can lead to lower interest rates, saving you money over the life of the loan.

Real-Life Examples of FICO Score Impact

- Example 1: Sarah and John both apply for a mortgage. Sarah has an excellent FICO score of 800, while John’s score is 600. Sarah receives a lower interest rate on her loan, resulting in significant savings compared to John over the loan term.

- Example 2: Mark applies for a car loan with a FICO score of 750, while Lisa applies with a score of 650. Mark is approved for the loan with a more favorable interest rate, allowing him to finance his car at a lower cost than Lisa.

Monitoring and Managing FICO Scores

Monitoring and managing your FICO scores is crucial for maintaining good financial health. By keeping track of your scores, you can identify any issues early on and take steps to improve them.

Tools and Resources for Monitoring FICO Scores

There are several tools and resources available to help you monitor your FICO scores:

- Free Credit Report: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) every year. Take advantage of this to review your credit history and FICO scores.

- Credit Monitoring Services: Consider using credit monitoring services that provide regular updates on your credit report and FICO scores. Some services even offer identity theft protection.

- FICO Score Apps: There are apps available that allow you to track your FICO scores and receive alerts for any changes. These apps can help you stay on top of your credit health.

Importance of Regular FICO Score Check-Ups

Regularly checking your FICO scores is essential for the following reasons:

- Identifying Errors: Monitoring your scores allows you to catch any errors on your credit report, such as inaccuracies or fraudulent activity. Resolving these errors promptly can prevent negative impacts on your credit.

- Tracking Progress: By keeping tabs on your FICO scores over time, you can see how your financial habits and actions affect your credit health. This information can help you make positive changes to improve your scores.

- Early Detection: Monitoring your scores regularly can help you detect any signs of identity theft or unauthorized activity on your credit report. Addressing these issues early can minimize the damage to your credit.

Steps for Resolving Errors on FICO Reports

If you spot errors on your FICO reports, follow these steps to resolve them:

- Notify Credit Bureaus: Contact the credit bureaus (Equifax, Experian, TransUnion) in writing to report the errors on your credit report.

- Provide Documentation: Include copies of any supporting documents that prove the errors on your credit report. This could include bank statements, payment records, or identity verification.

- Follow Up: Stay in touch with the credit bureaus to ensure they investigate the errors and make corrections. Monitor your credit report to confirm that the changes have been made.