Compounding interest, a crucial concept in finance, has the ability to significantly boost wealth accumulation over time. Picture this: your money makes money, and that money makes more money – compounding at its finest. Let’s dive into the world of compounding interest with a fresh perspective that will leave you eager to learn more.

As we explore the intricacies of compounding interest, you’ll uncover how this financial phenomenon can work in your favor to build a prosperous future. Get ready to witness the magic of exponential growth in your investments as we break down the concept step by step.

What is Compounding Interest?

Compounding interest is the process where your money earns interest on both the initial principal amount and the accumulated interest from previous periods. In simple terms, it means you earn interest on your interest.

Difference from Simple Interest

Unlike simple interest, which is calculated only on the principal amount, compounding interest allows your money to grow exponentially over time. This is because the interest you earn is added to the principal, resulting in a larger amount for the next interest calculation.

Examples of Compounding Interest

- If you invest $1,000 in a savings account with an annual interest rate of 5%, at the end of the first year, you will have $1,050. In the second year, you will earn 5% interest on $1,050, not just on the initial $1,000. This cycle continues, leading to higher returns over time.

- Another example is a 30-year mortgage where you pay interest on the outstanding balance each month. As you make payments, the interest is recalculated based on the reduced principal amount, allowing you to save money on interest payments in the long run.

Benefits of Compounding Interest

When it comes to building wealth, compounding interest is the real deal. It’s like a money-making snowball that grows bigger and faster as time goes on. Let’s break down the advantages of compounding interest and see how it can accelerate your journey to financial success.

Growth Over Time

- With compounding interest, your money earns interest on both the initial investment and the interest that has already been added. This means your wealth grows exponentially, not just linearly like simple interest.

- Over time, the power of compounding interest can turn a modest investment into a substantial sum. The longer you let your money work for you, the more impressive the growth will be.

Accelerated Wealth Accumulation

- Compounding interest accelerates wealth accumulation by allowing your earnings to generate even more earnings. This creates a snowball effect where your money multiplies faster than you could imagine.

- By reinvesting your earnings back into your investment, you can take advantage of compounding interest to reach your financial goals sooner than you thought possible.

How to Calculate Compounding Interest

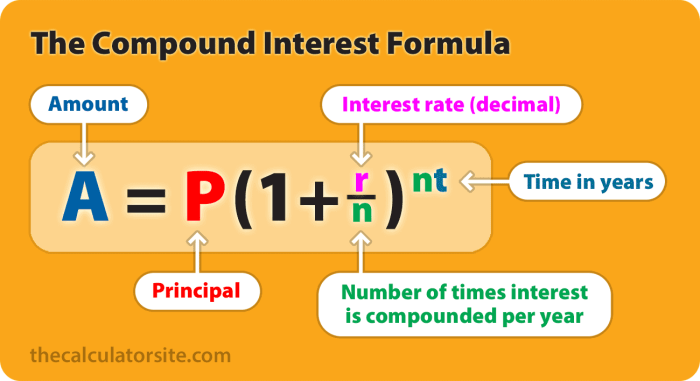

When it comes to calculating compounding interest, it’s important to understand the formula and how different compounding frequencies can impact the amount of interest earned.To calculate the future value of an investment with compounding interest, you can use the following formula:

Future Value = P(1 + r/n)^(nt)

Where:

- P is the principal amount (initial investment)

- r is the annual interest rate (in decimal form)

- n is the number of times that interest is compounded per year

- t is the number of years the money is invested for

Calculating Interest with Different Compounding Frequencies

- For annual compounding (n = 1), use the formula: Future Value = P(1 + r)^t

- For semi-annual compounding (n = 2), use the formula: Future Value = P(1 + r/2)^(2t)

- For quarterly compounding (n = 4), use the formula: Future Value = P(1 + r/4)^(4t)

- For monthly compounding (n = 12), use the formula: Future Value = P(1 + r/12)^(12t)

Impact of Compounding Periods on Interest Earned, Compounding interest

- Increasing the compounding frequency leads to higher returns due to more frequent interest calculations.

- Compounding more frequently can significantly boost the overall growth of your investment over time.

- The power of compounding interest is evident when you compare the results of different compounding periods.

Strategies to Maximize Compounding Interest

When it comes to maximizing compounding interest, there are some key strategies to keep in mind. By understanding and implementing these strategies, you can make the most of your investments and see significant growth over time.

Start Early and Stay Invested

One of the most powerful ways to maximize compounding interest is to start investing early and stay invested for a longer period. The earlier you start investing, the more time your money has to grow through compounding. Even small regular contributions can lead to significant wealth over time due to the power of compounding. For example, if you start investing in your 20s and consistently contribute to your investment account, you can see substantial growth by the time you reach retirement age.

Diversify Your Investments

Another important strategy is to diversify your investments. By spreading your investments across different asset classes, industries, and regions, you can reduce risk and potentially increase your overall returns. Diversification can help you weather market fluctuations and take advantage of different opportunities for growth.

Reinvest Your Earnings

To fully harness the power of compounding interest, consider reinvesting your earnings back into your investments. By reinvesting dividends, interest, or capital gains, you can accelerate the growth of your investment portfolio. This allows you to take advantage of compounding on a larger base, leading to even greater returns over time.

Regularly Monitor and Adjust Your Portfolio

It’s essential to regularly monitor your investment portfolio and make adjustments as needed. Keep track of your investments’ performance, and consider rebalancing your portfolio to ensure it aligns with your financial goals and risk tolerance. By staying proactive and making informed decisions, you can optimize your portfolio for maximum returns through compounding interest.