Expense tracking apps are essential in today’s digital age for effectively managing your finances. From budgeting to saving money, these apps offer a range of features to streamline your financial tasks. Let’s dive into the world of expense tracking apps and explore how they can revolutionize your money management game.

Overview of Expense Tracking Apps

Expense tracking apps are designed to help individuals keep a close eye on their spending habits and manage their finances more effectively. These apps offer a convenient way for users to track their expenses, categorize transactions, set budgets, and analyze their financial health.

Purpose of Expense Tracking Apps

Expense tracking apps serve as a digital tool to monitor and record all expenses made by an individual. By logging each transaction, users can gain a clear understanding of where their money is going, identify areas where they can cut back, and ultimately achieve their financial goals more efficiently.

How Expense Tracking Apps Help Users Manage Finances

- Provide a centralized platform to track all expenses in one place.

- Categorize transactions to easily identify spending patterns.

- Set budgets and receive alerts when nearing or exceeding limits.

- Generate reports and insights to analyze financial health and make informed decisions.

- Sync with bank accounts and credit cards for real-time updates.

Comparison of Features in Different Expense Tracking Apps

- App A: Offers a user-friendly interface with customizable spending categories.

- App B: Provides automatic categorization of transactions for quick analysis.

- App C: Allows users to set specific financial goals and track progress over time.

- App D: Integrates with other financial tools like investment trackers and bill payment services.

Benefits of Using Expense Tracking Apps

Using expense tracking apps can bring a plethora of advantages to personal finance management. These apps offer a convenient and efficient way to monitor spending, save money, and simplify budgeting processes.

Organized Expense Monitoring

Expense tracking apps provide users with a centralized platform to monitor all their expenses in one place. By categorizing expenses and generating detailed reports, users can easily track where their money is going and identify areas where they can cut back.

Smart Savings Strategies

Expense tracking apps help users save money by highlighting spending patterns and offering insights on potential savings opportunities. By setting budget limits, receiving alerts for overspending, and analyzing spending habits, users can make informed financial decisions that lead to significant savings over time.

Effortless Budget Management

These apps simplify the budgeting process by automating tasks such as expense categorization, bill reminders, and financial goal tracking. Users can create customized budgets, set financial goals, and visualize their financial health through interactive graphs and charts, making it easier to stay on top of their finances.

Key Features to Look for in Expense Tracking Apps

When choosing an expense tracking app, it’s essential to look for specific key features that will make your financial management more efficient and effective.

Real-Time Syncing Across Devices

One crucial feature to consider in an expense tracking app is real-time syncing across devices. This allows you to update your expenses on one device and have the changes reflected instantly on all your other devices. It ensures that you always have the most up-to-date financial information at your fingertips, no matter where you are.

Data Security and Privacy Features

Another critical aspect to look for in an expense tracking app is robust data security and privacy features. Your financial information is sensitive and should be protected from unauthorized access or breaches. Look for apps that offer encryption, secure login methods, and data backup to ensure that your data remains safe and confidential.

Popular Expense Tracking Apps in the Market

![]()

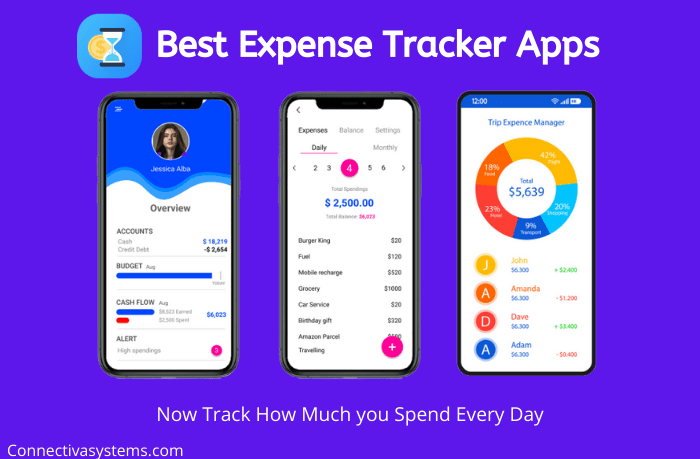

When it comes to managing your expenses, there are several popular apps in the market that can help you stay on top of your finances. Let’s take a look at some of the top expense tracking apps like Mint, YNAB, and Expensify.

Mint

Mint is a free budgeting app that helps you track your expenses, create budgets, and set financial goals. It automatically categorizes your transactions and provides insights into your spending habits. Users appreciate the ease of use and comprehensive features offered by Mint.

YNAB (You Need A Budget)

YNAB is a subscription-based budgeting app that focuses on giving every dollar a job. It helps you prioritize your spending, save money, and eliminate debt. While some users find the subscription cost a bit high, many praise YNAB for its effective budgeting methodology.

Expensify

Expensify is a popular app for tracking business expenses and generating expense reports. It simplifies the process of capturing receipts, tracking mileage, and managing expenses for reimbursement. Users find Expensify particularly useful for business-related expenses.Overall, each of these apps offers unique features and benefits to help you manage your expenses more effectively.