How to use fundamental analysis in forex trading takes center stage, inviting readers into a world of financial insight. Dive into the realm of currency valuation with a fresh perspective and expert guidance.

Unravel the complexities of economic indicators and geopolitical events in the forex market to enhance your trading strategies.

Understanding Fundamental Analysis in Forex Trading

Fundamental analysis in forex trading involves evaluating the intrinsic value of a currency based on various economic indicators and factors rather than just looking at price movements on charts. It helps traders understand the underlying factors driving currency movements.

Key Factors Considered in Fundamental Analysis

- Economic Indicators: These include GDP, inflation rates, employment data, and consumer spending, among others. Positive or negative changes in these indicators can impact currency prices.

- Central Bank Policies: Decisions made by central banks regarding interest rates, monetary policy, and quantitative easing can influence currency values.

- Geopolitical Events: Political instability, trade agreements, and global conflicts can also affect currency markets.

Impact of Economic Indicators on Currency Prices

- Example 1: Non-Farm Payroll (NFP) Report – A higher-than-expected NFP number can lead to a stronger US dollar as it indicates a robust job market and potential interest rate hikes by the Federal Reserve.

- Example 2: Gross Domestic Product (GDP)

-A country’s GDP growth rate can impact its currency value. Higher GDP growth usually strengthens the currency, while lower growth can weaken it.

Economic Indicators to Consider: How To Use Fundamental Analysis In Forex Trading

When conducting fundamental analysis for forex trading, it is crucial to consider various economic indicators that can have a significant impact on currency valuation. These indicators provide valuable insights into the overall health and performance of a country’s economy, helping traders make informed decisions.

Interest Rates and Currency Valuation

Interest rates play a crucial role in determining the value of a currency. Central banks use interest rates as a tool to control inflation and stimulate economic growth. When interest rates are raised, it typically leads to an appreciation of the currency as higher rates attract foreign capital. Conversely, when interest rates are lowered, the currency tends to depreciate as investors seek higher returns elsewhere.

Therefore, monitoring interest rate decisions and forecasts is essential for forex traders.

Significance of GDP Reports in Forex Trading

Gross Domestic Product (GDP) reports are among the most important economic indicators used in forex trading. GDP measures the total value of all goods and services produced within a country’s borders over a specific period. A strong GDP growth rate indicates a healthy economy, which can lead to a stronger currency. Conversely, a decline in GDP growth may signal economic weakness and result in a depreciation of the currency.

Traders closely monitor GDP reports to assess the overall economic performance of a country and make trading decisions accordingly.

Using Fundamental Analysis for Currency Valuation

Fundamental analysis plays a crucial role in determining the intrinsic value of a currency by focusing on various economic factors, such as interest rates, GDP growth, inflation rates, and political stability. This analysis helps traders and investors understand the underlying forces that drive a currency’s value in the long run.

Impact of Fundamental Analysis vs. Technical Analysis on Currency Valuation

When it comes to currency valuation, fundamental analysis and technical analysis are two primary methods used by traders. Fundamental analysis looks at the economic factors affecting a currency’s value, while technical analysis focuses on historical price movements and chart patterns. While technical analysis is more short-term oriented and focuses on price action, fundamental analysis provides a broader perspective on the market by examining the underlying economic conditions.

- Fundamental analysis considers factors like interest rates, inflation, political stability, and economic indicators to assess a currency’s value.

- Technical analysis relies on historical price data and chart patterns to predict future price movements.

- Both approaches have their strengths and weaknesses, and many traders use a combination of both to make well-informed trading decisions.

Geopolitical Events Influencing Forex Markets based on Fundamental Analysis

Geopolitical events can have a significant impact on forex markets as they can disrupt economic stability, affect trade agreements, and create uncertainty in the market. Some examples of geopolitical events that influence forex markets based on fundamental analysis include:

-

Political elections

: Elections in major economies can lead to changes in government policies, affecting the country’s currency.

-

Trade wars

: Disputes between countries over trade agreements can cause fluctuations in currency values.

-

Natural disasters

: Events like hurricanes, earthquakes, or pandemics can disrupt a country’s economy and impact its currency.

-

Central bank decisions

: Monetary policy decisions by central banks, such as interest rate changes, can have a significant impact on currency valuation.

Incorporating News Events into Trading Strategy

When it comes to forex trading, incorporating news events into your trading strategy is crucial for making informed decisions and maximizing your profits. News events and economic data releases can have a significant impact on currency values, so staying informed and knowing how to interpret these events is key to success in the forex market.

The Role of News Events in Fundamental Analysis, How to use fundamental analysis in forex trading

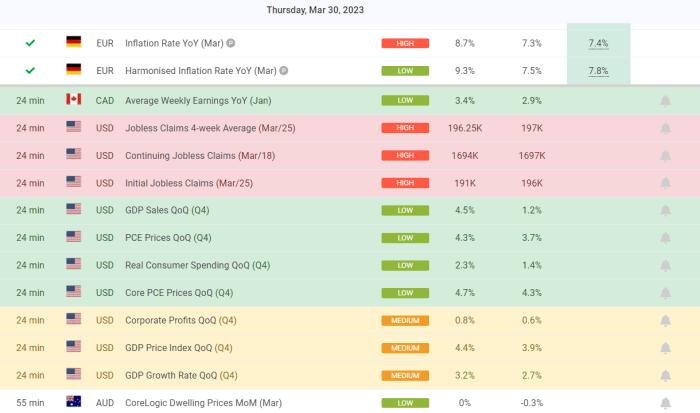

- News events such as central bank announcements, economic reports, and geopolitical developments can cause volatility in the forex market.

- Traders use these events to assess the health of economies, predict interest rate changes, and anticipate market trends.

- Understanding the impact of news events on currency pairs can help traders identify trading opportunities and manage risk effectively.

Interpreting News Events for Informed Trading Decisions

- Pay attention to high-impact news events that can move the market significantly, such as Non-Farm Payrolls, GDP releases, and interest rate decisions.

- Consider the consensus forecasts and previous data to gauge market expectations and potential market reactions to the news event.

- Look for surprises or deviations from expectations, as they can lead to sharp price movements and trading opportunities.

Integrating News Analysis with Fundamental Analysis

- Combine news analysis with fundamental analysis to get a comprehensive view of the market and make well-informed trading decisions.

- Use economic calendars to track upcoming news events and plan your trading strategy accordingly.

- Stay updated on market sentiment and news sentiment to gauge the market’s reaction to news events and adjust your trading approach accordingly.