Mutual funds vs. ETFs – two heavyweight contenders in the investment ring, each with its unique style and strategy. Let’s dive into the ring and see who comes out on top!

In the left corner, we have mutual funds, known for their traditional approach to investing. In the right corner, ETFs stand tall with their innovative and flexible structure. It’s a battle of old school vs. new school, so buckle up for an exciting showdown!

Introduction

Mutual funds and ETFs are both popular investment options in the financial market. Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager. On the other hand, ETFs (Exchange Traded Funds) are similar to mutual funds in that they also pool money from investors, but they are traded on stock exchanges like individual stocks.

Key Differences

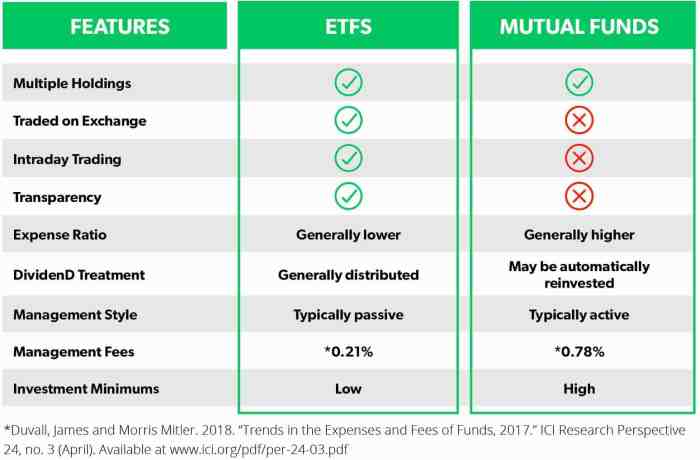

- Mutual funds are bought and sold at their net asset value (NAV) at the end of the trading day, while ETFs are traded throughout the day on stock exchanges at market prices.

- Mutual funds are actively managed by fund managers who make decisions on buying and selling securities, while most ETFs are passively managed to track a specific index.

- ETFs typically have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

Popularity and Growth

Mutual funds have been a popular choice for many investors for decades, offering diversification and professional management. However, ETFs have gained popularity in recent years due to their lower costs, tax efficiency, and trading flexibility. The growth of ETFs has outpaced that of mutual funds, reflecting the changing preferences of investors in the evolving financial landscape.

Structure and Management

When it comes to the structure and management of mutual funds and ETFs, there are some key differences to consider. Let’s break it down for you:

Structure of Mutual Funds and ETFs

- Mutual Funds: Mutual funds are actively managed by professional portfolio managers who make investment decisions on behalf of the fund. They pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- ETFs: ETFs are passively managed and typically track a specific index, such as the S&P 500. They are traded on stock exchanges like individual stocks and offer investors exposure to a specific market segment.

Management Styles of Mutual Funds and ETFs

- Mutual Funds: With mutual funds, investors rely on the expertise of the fund manager to actively buy and sell securities in an attempt to outperform the market. This active management style often leads to higher fees for investors.

- ETFs: ETFs follow a passive management style, aiming to replicate the performance of a specific index. This typically results in lower fees compared to actively managed mutual funds.

Buying and Selling Shares in Mutual Funds and ETFs

- Mutual Funds: Investors can buy and sell shares of mutual funds directly from the fund company or through a broker. Mutual funds are priced at the end of the trading day based on the net asset value (NAV) of the underlying securities.

- ETFs: ETFs are traded on stock exchanges throughout the trading day at market prices. Investors can buy and sell ETF shares through a brokerage account, just like they would with individual stocks.

Costs and Fees

When it comes to investing in mutual funds or ETFs, it’s essential to understand the costs and fees associated with each option. These expenses can have a significant impact on your overall returns as an investor.

Fee Analysis

Investors in mutual funds typically encounter higher expense ratios compared to ETFs. Mutual funds often have higher management fees and operating expenses, which can eat into your returns over time. On the other hand, ETFs generally have lower expense ratios due to their passive management style and lower operating costs.

- Mutual funds: Expense ratios for mutual funds can range from around 0.5% to 2% or more, depending on the fund’s strategy and management style.

- ETFs: ETFs usually have lower expense ratios, typically ranging from 0.05% to 0.75%.

It’s important to consider these expense ratios carefully, as even seemingly small differences can have a significant impact on your investment returns over time.

Impact on Returns

The costs and fees associated with mutual funds and ETFs can impact your overall returns as an investor. Higher expense ratios in mutual funds can reduce the amount of returns you receive on your investment, especially over the long term. On the other hand, lower expense ratios in ETFs can help investors keep more of their returns.

- Example: If you invest $10,000 in a mutual fund with a 2% expense ratio and it earns a 5% return, you would only see a net return of 3% after accounting for fees.

- Example: In contrast, if you invest $10,000 in an ETF with a 0.5% expense ratio and it earns a 5% return, you would see a net return of 4.5% after fees.

Performance and Risks

When it comes to evaluating the historical performance of mutual funds and ETFs, investors often look at the returns generated over a certain period of time. These returns can vary based on market conditions, investment strategies, and the specific assets held within the fund. On the other hand, risks associated with investing in mutual funds and ETFs include market risk, liquidity risk, and credit risk.

Factors such as economic conditions, interest rate changes, and geopolitical events can impact the performance of these investment vehicles.

Historical Performance

- Mutual funds have traditionally been known for their active management approach, with fund managers making decisions on which securities to buy and sell. This can lead to potential outperformance but also higher fees.

- ETFs, on the other hand, typically track a specific index or asset class, providing investors with exposure to a diversified portfolio at a lower cost. This passive approach can result in lower returns compared to actively managed mutual funds.

- Over the long term, historical data has shown that mutual funds have struggled to consistently outperform the market after accounting for fees, while ETFs have provided more consistent returns in line with the market.

Risks Associated

- Market Risk: Both mutual funds and ETFs are subject to market fluctuations, which can impact the value of their underlying assets.

- Liquidity Risk: In times of market stress, investors may find it difficult to sell their mutual fund or ETF shares at a fair price due to a lack of liquidity in the market.

- Credit Risk: Mutual funds and ETFs that invest in bonds or other fixed-income securities are exposed to the risk of default by the issuer, which can lead to losses for investors.

Factors Impacting Performance

- Asset Allocation: The mix of assets held within a mutual fund or ETF can greatly impact its performance. Diversification across different asset classes can help mitigate risk and enhance returns.

- Management Style: The active vs. passive management approach taken by mutual funds and ETFs can influence their performance. Active management involves higher fees but the potential for outperformance, while passive management offers lower fees but more consistent returns in line with the market.

- Market Conditions: Economic factors, interest rate changes, and geopolitical events can all affect the performance of mutual funds and ETFs. It’s important for investors to stay informed about these external factors to make informed investment decisions.

Tax Efficiency and Distributions

When it comes to investing in mutual funds and ETFs, understanding the tax implications and how distributions are handled is crucial for maximizing returns and managing tax liabilities.

Tax Treatment in Mutual Funds and ETFs

Both mutual funds and ETFs can generate taxable events for investors. However, the way taxes are handled differs between the two investment vehicles.

- Mutual Funds: Mutual funds are required to distribute capital gains to shareholders, which are subject to capital gains tax. Additionally, investors may also be liable for taxes on dividends and interest income generated by the fund.

- ETFs: ETFs are generally more tax-efficient compared to mutual funds. Since ETFs are traded on the stock exchange, investors have more control over when they realize capital gains. This can result in lower tax liabilities for investors.

Comparing Tax Efficiency

When it comes to tax efficiency, ETFs have a clear advantage over mutual funds. The ability to control the timing of capital gains realization in ETFs can lead to lower tax liabilities for investors, making them a more tax-efficient investment option.

Distributions in Mutual Funds and ETFs

Distributions in mutual funds and ETFs refer to the dividends, interest, and capital gains that are paid out to investors. These distributions can have tax implications for investors depending on the type of account they hold the investments in.

- Mutual Funds: Mutual funds typically distribute capital gains and income to investors annually, which are subject to taxes. Investors may receive these distributions in cash or reinvest them back into the fund.

- ETFs: ETFs also distribute dividends, interest, and capital gains to investors, but the tax implications are usually lower compared to mutual funds. Investors in ETFs may receive these distributions in cash or reinvest them based on their preference.

Investment Options and Flexibility: Mutual Funds Vs. ETFs

When it comes to investment options and flexibility, both mutual funds and ETFs offer a wide range of choices for investors. Let’s take a closer look at how these investment vehicles provide flexibility and options for investors.

Variety of Investment Options, Mutual funds vs. ETFs

- Mutual funds: Mutual funds offer a variety of options such as stock funds, bond funds, index funds, sector funds, and more. Investors can choose funds that align with their financial goals and risk tolerance.

- ETFs: ETFs also provide a range of investment options, including broad market index funds, sector-specific ETFs, commodity ETFs, and more. Investors have the flexibility to invest in specific sectors or asset classes.

Liquidity and Trading Flexibility

- Mutual funds: Mutual funds are priced once a day after the market closes, and investors can only buy or sell shares at that price. This may limit real-time trading flexibility.

- ETFs: ETFs trade on an exchange throughout the day, allowing investors to buy and sell shares at market prices. This provides greater liquidity and flexibility for investors.

Diversification Benefits

- Both mutual funds and ETFs offer investors the opportunity to diversify their portfolios by investing in a mix of assets. This can help reduce risk and exposure to market volatility.

- Investors can use mutual funds and ETFs to create a diversified portfolio that includes different asset classes, sectors, and regions, spreading risk across various investments.