Stepping into the world of mortgage pre-approval process, you’re about to embark on a journey filled with crucial information and expert insights. Buckle up as we break down the intricate steps and key components that shape this essential phase of home buying.

In the following sections, we will explore the required documentation, dive into the significance of credit score and financial history, unravel the mysteries of debt-to-income ratio, highlight the benefits of pre-approval, and shed light on the timeframe and validity of this process. Get ready to navigate the world of mortgage pre-approval like a pro!

Overview of Mortgage Pre-Approval Process

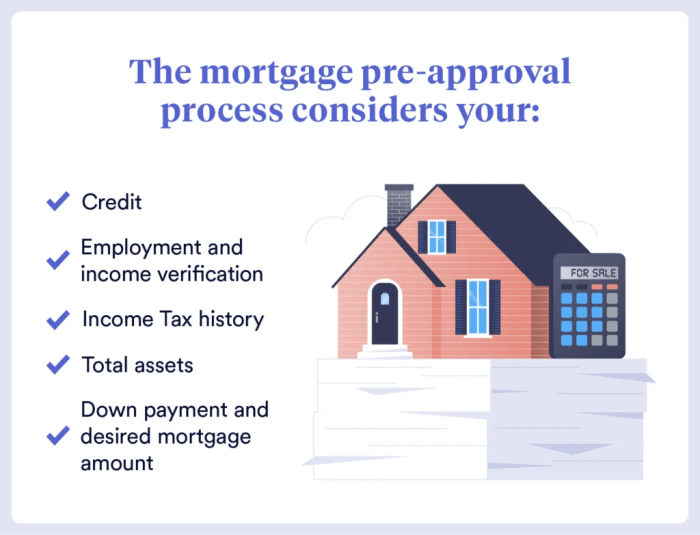

When it comes to buying a house, getting a mortgage pre-approval is a crucial step in the process. This involves a lender reviewing your financial information and determining how much they are willing to lend you for a mortgage.

Importance of Mortgage Pre-Approval

Having a pre-approval letter in hand before you start house hunting can give you a competitive edge. Sellers are more likely to take you seriously and consider your offer if they see that you have already been pre-approved for a mortgage.

Steps Involved in Pre-Approval Process

- Submit an application: You will need to provide detailed information about your income, assets, debts, and credit history.

- Documentation review: The lender will review your financial documents to assess your creditworthiness.

- Pre-approval letter: If you meet the lender’s criteria, you will receive a pre-approval letter stating the loan amount you qualify for.

Required Documentation

To get pre-approved for a mortgage, you’ll need to gather a variety of documents that demonstrate your financial stability and ability to repay the loan. These documents are crucial in the pre-approval process as they help lenders assess your creditworthiness and determine the amount you can borrow.

Proof of Income

- Pay stubs: Provide your most recent pay stubs to show your current income.

- W-2 forms: Submit your W-2 forms from the past two years to verify your income history.

- Tax returns: Include your tax returns from the past two years to show your income stability.

Proof of Assets

- Bank statements: Provide bank statements from the past few months to show your savings and assets.

- Investment accounts: Include statements from any investment accounts to demonstrate additional assets.

- Retirement accounts: Submit statements from your retirement accounts to show long-term financial stability.

Credit History

- Credit report: Lenders will pull your credit report to assess your credit score and payment history.

- Credit card statements: Provide statements from your credit cards to show your current debt and payment history.

- Loan statements: Include statements from any outstanding loans to demonstrate your debt obligations.

Credit Score and Financial History

Having a good credit score and solid financial history plays a crucial role in the mortgage pre-approval process. Lenders use this information to assess your creditworthiness and determine the terms of your loan.

Credit Score

Your credit score is a three-digit number that reflects your creditworthiness based on your credit history. Lenders use this score to evaluate how likely you are to repay your loan on time. A higher credit score typically results in better loan terms, such as lower interest rates and higher loan amounts. A credit score of 620 or higher is generally considered good for mortgage approval.

- Pay your bills on time to avoid negative marks on your credit report.

- Keep your credit card balances low and avoid opening new lines of credit before applying for a mortgage.

- Regularly check your credit report for errors and dispute any inaccuracies to improve your score.

Financial History

Your financial history includes factors like your income, employment history, and debt-to-income ratio. Lenders review this information to ensure you have a stable income and are capable of repaying the loan.

- Provide complete and accurate documentation of your income, including pay stubs, tax returns, and bank statements.

- Minimize your existing debts and avoid taking on new debt before applying for a mortgage.

- Have a steady employment history to demonstrate financial stability to lenders.

Debt-to-Income Ratio and Affordability

When applying for a mortgage pre-approval, one crucial factor that lenders assess is your debt-to-income ratio. This ratio compares your monthly debt payments to your gross monthly income, giving lenders an idea of how much of your income goes towards paying off debts.

Importance of Debt-to-Income Ratio

- Lenders use the debt-to-income ratio to determine your ability to manage monthly mortgage payments along with your existing debts.

- A lower debt-to-income ratio indicates a healthier financial situation and a higher likelihood of loan approval.

- Typically, lenders prefer a debt-to-income ratio of 43% or lower, although some may accept higher ratios under certain circumstances.

Assessing Affordability

- Lenders assess affordability by looking at your income, debts, and debt-to-income ratio to determine how much you can comfortably afford to borrow.

- They consider not only your current debts but also the potential mortgage payment, property taxes, insurance, and other housing-related expenses.

- By analyzing these factors, lenders can estimate the maximum loan amount you qualify for based on your financial situation.

Improving Debt-to-Income Ratio

- To improve your debt-to-income ratio and qualify for a higher loan amount, consider paying off existing debts or increasing your income.

- Reducing high-interest debt can significantly lower your monthly payments, thus improving your debt-to-income ratio.

- Increasing your income through a raise, side hustle, or additional sources of revenue can also help lower your debt-to-income ratio.

- It’s essential to maintain a good balance between your income and debts to demonstrate financial stability to lenders.

Benefits of Mortgage Pre-Approval

When it comes to shopping for a home, having a mortgage pre-approval can provide numerous advantages that can make the home buying process smoother and more efficient.

Advantages of Mortgage Pre-Approval

- Clear Budget: With a pre-approval, you’ll know exactly how much you can afford to spend on a home, making it easier to narrow down your search and focus on properties within your budget.

- Stronger Negotiating Power: Sellers are more likely to take your offer seriously if you have a pre-approval, as it shows that you are a serious buyer who can secure financing.

- Faster Closing Process: Pre-approval can speed up the closing process since much of the paperwork and verification has already been completed, allowing you to close on your new home more quickly.

Pre-Approval vs. Pre-Qualification

- Pre-Approval: A pre-approval involves a thorough review of your financial background, including a credit check and verification of income and assets. This gives you a more accurate picture of how much you can borrow.

- Pre-Qualification: Pre-qualification is a more basic assessment based on self-reported information. While it can give you a general idea of what you might qualify for, it doesn’t carry the same weight as a pre-approval.

Strengthening Buyer’s Position

- Competitive Market: In a competitive real estate market, having a pre-approval can give you an edge over other buyers who may not have their financing in place. This can make your offer more attractive to sellers.

- Smoother Process: By being pre-approved, you can avoid any surprises or delays during the home buying process, giving you more confidence and peace of mind as you move forward with your purchase.

Timeframe and Validity

When you receive a mortgage pre-approval, it’s important to note that it is not indefinite. Typically, a pre-approval is valid for about 60-90 days, but this can vary depending on the lender and other factors.

Factors Affecting Validity Period

- Changes in Financial Situation: Any significant changes in your financial situation, such as a job loss or taking on new debt, can affect the validity of your pre-approval.

- Interest Rate Changes: Fluctuations in interest rates can impact the terms of your pre-approval, potentially shortening its validity.

- Expiration Date: Make sure to keep track of the expiration date of your pre-approval to avoid any issues.

What to Do If Pre-Approval Expires

If your pre-approval expires before you find a home, don’t panic. You can reach out to your lender to see if they can extend the validity period. In some cases, you may need to provide updated documentation to ensure your pre-approval remains current. It’s essential to communicate with your lender throughout the process to avoid any surprises.