With debt repayment strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Debt is a common reality for many individuals, but with the right plan in place, it can be managed effectively. In this guide, we will explore different strategies to tackle debt and pave the way for a brighter financial future.

Overview of Debt Repayment Strategies

When it comes to managing debt, having a structured repayment plan is crucial for financial stability and peace of mind. A well-thought-out strategy can help individuals pay off debts efficiently and avoid falling into a cycle of debt.

Types of Debts in a Repayment Strategy

- Credit Card Debt: High-interest debt that can quickly accumulate if not paid off regularly.

- Student Loans: Long-term debt that requires consistent payments to avoid default.

- Personal Loans: Fixed-term loans with regular installments that need to be repaid on time.

Benefits of a Debt Repayment Plan

- Reduced Stress: Knowing exactly how much to pay and when can alleviate financial anxiety.

- Lower Interest Payments: By prioritizing high-interest debts, individuals can save money on interest in the long run.

- Improved Credit Score: Timely payments and reducing debt balances can positively impact credit scores.

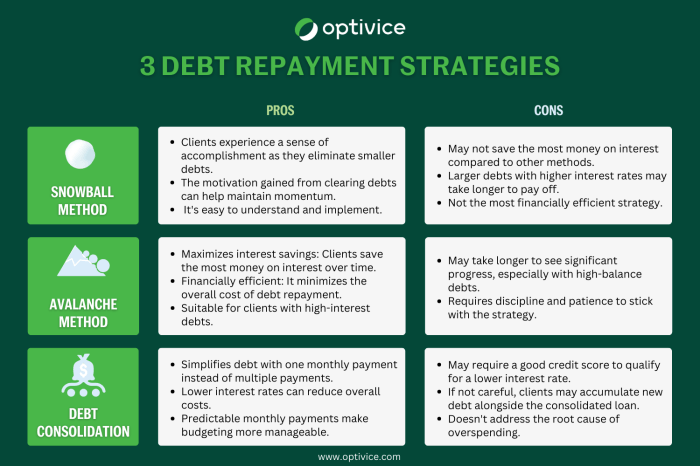

Snowball Method

The snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on all other debts. Once the smallest debt is paid off, you take the money you were putting towards that debt and apply it to the next smallest debt, creating a snowball effect that helps you pay off larger debts more quickly.

How the Snowball Method Works

- List all your debts from smallest to largest.

- Make minimum payments on all debts except the smallest one.

- Put any extra money towards paying off the smallest debt.

- Once the smallest debt is paid off, roll that payment amount into the next smallest debt.

- Repeat this process until all debts are paid off.

Examples of Implementing the Snowball Method

- If you have a $500 credit card debt, a $1,000 personal loan, and a $5,000 car loan, you would focus on paying off the credit card first, then the personal loan, and finally the car loan.

- After paying off the credit card, you would take the money you were putting towards it and apply it to the personal loan until that is paid off.

- Finally, you would use the combined payments from the credit card and personal loan to tackle the car loan.

Comparison with Other Debt Repayment Strategies

- The snowball method focuses on psychological wins by paying off smaller debts first, which can provide motivation to keep going. In contrast, the avalanche method prioritizes debts with the highest interest rates to save money in the long run.

- While the snowball method may cost more in interest overall compared to the avalanche method, some individuals find the sense of progress and accomplishment from paying off smaller debts first to be more beneficial for their financial journey.

Avalanche Method

When it comes to debt repayment strategies, the avalanche method is another popular approach that differs from the snowball method in its approach to tackling debt. While the snowball method focuses on paying off debts from smallest to largest regardless of interest rates, the avalanche method prioritizes debts with the highest interest rates first.

Steps Involved in Using the Avalanche Method

- List all your debts from the one with the highest interest rate to the one with the lowest.

- Allocate a fixed amount of money each month to cover the minimum payments on all debts.

- Any extra funds should be directed towards paying off the debt with the highest interest rate first.

- Once the debt with the highest interest rate is paid off, move on to the next highest interest rate debt and repeat the process.

Situations Where the Avalanche Method May Be More Beneficial

- If you have debts with significantly high interest rates, the avalanche method can help you save money in the long run by reducing the amount of interest you pay over time.

- Individuals who are more financially disciplined and can resist the psychological benefits of seeing quick wins (like in the snowball method) may find the avalanche method more suitable for their repayment strategy.

Debt Consolidation

Debt consolidation is a strategy where multiple debts are combined into a single loan or payment to make it more manageable. This can involve taking out a new loan to pay off existing debts or transferring balances to a single credit card with a lower interest rate.

Pros and Cons of Debt Consolidation

- Pros:

- Streamlines payments: By consolidating debts, you only have to worry about one monthly payment, making it easier to keep track of your finances.

- Lower interest rates: If you can secure a lower interest rate through consolidation, you may end up paying less in interest over time.

- Potential for better terms: Consolidation can sometimes offer more favorable repayment terms, such as longer repayment periods or lower monthly payments.

- Cons:

- Potential for higher overall costs: While you may have a lower interest rate, extending the repayment period can lead to paying more in total interest.

- Risk of accumulating more debt: Consolidating debts can free up credit lines, leading some individuals to accumulate more debt if spending habits are not addressed.

- Impact on credit score: Opening a new credit account or taking out a loan for consolidation can temporarily lower your credit score.

Tips for Effective Debt Consolidation

- Evaluate your financial situation: Before consolidating debts, assess your current financial standing, including total debt, interest rates, and monthly payments.

- Compare consolidation options: Research different consolidation methods, such as personal loans, balance transfer credit cards, or home equity loans, to find the best fit for your needs.

- Consider seeking professional advice: Consulting with a financial advisor or credit counselor can help you navigate the consolidation process and make informed decisions.

- Create a repayment plan: Develop a realistic repayment plan that includes a budget, payment schedule, and goals for becoming debt-free.

- Monitor your progress: Stay on top of your debt repayment plan by tracking your payments, adjusting as needed, and staying committed to your financial goals.