Diving into the world of loan interest calculation, get ready to explore the ins and outs of how interest rates are determined and the impact they have on your financial decisions. From simple interest to compound interest, we’ll break it down in a way that’s easy to understand yet totally rad.

Get ready to level up your knowledge on loan interest calculation as we explore the methods, factors, and terms that play a crucial role in the borrowing game.

Loan Interest Calculation Methods

When it comes to calculating loan interest, there are different methods that lenders use. The two main methods are simple interest calculation and compound interest calculation. Let’s compare and contrast these two methods and see when each one is most suitable.

Simple Interest Calculation

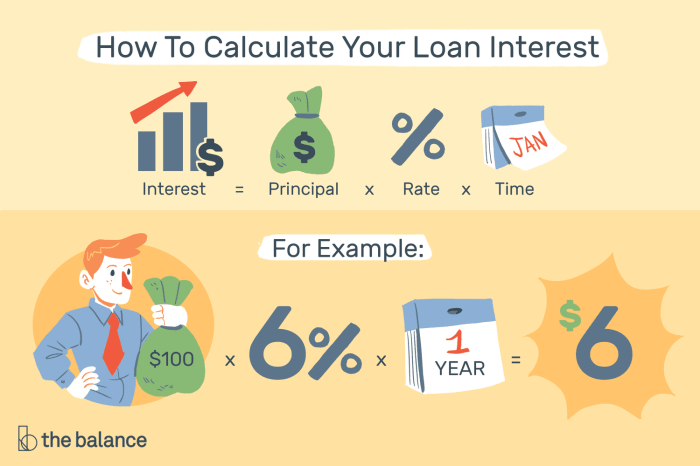

Simple interest is calculated based on the principal amount of the loan. The formula for simple interest is:

Simple Interest = Principal x Rate x Time

- Simple interest is most suitable for short-term loans with a fixed repayment schedule.

- It is easy to calculate and provides a straightforward understanding of how much interest will be paid over the life of the loan.

- Simple interest is commonly used for personal loans, auto loans, and small business loans.

Compound Interest Calculation

Compound interest takes into account the interest that accrues on both the principal amount and any accumulated interest. The formula for compound interest is:

Compound Interest = Principal x (1 + Rate)^Time – Principal

- Compound interest is suitable for long-term loans or investments where interest is reinvested or added to the principal.

- It allows for exponential growth of the loan balance over time, leading to higher overall interest payments.

- Compound interest is often used for mortgages, student loans, and investment accounts.

Factors Affecting Loan Interest Rates

When it comes to loan interest rates, there are several key factors that can influence how much you’ll end up paying. Understanding these factors can help you make informed decisions when borrowing money.

Inflation is a major factor that impacts loan interest rates. When inflation is high, the purchasing power of money decreases over time. Lenders will adjust interest rates to compensate for the decrease in value, which means borrowers end up paying more in interest. On the other hand, when inflation is low, interest rates tend to be lower as well.

Another important factor that plays a significant role in determining interest rates is your credit score. Lenders use credit scores to assess the risk of lending money to an individual. A higher credit score indicates that you are a reliable borrower who is likely to repay the loan on time. As a result, borrowers with higher credit scores are typically offered lower interest rates, while those with lower credit scores may face higher rates to offset the perceived risk.

Impact of Economic Conditions on Loan Interest Rates

Economic conditions such as unemployment rates, GDP growth, and the overall health of the economy can also influence loan interest rates. In times of economic uncertainty or recession, lenders may increase interest rates to mitigate the risk of defaults. Conversely, during periods of economic prosperity, interest rates may be lower to stimulate borrowing and spending.

Overall, understanding these factors can help you navigate the complex world of loan interest rates and make informed decisions when taking out a loan.

Understanding Annual Percentage Rate (APR)

When it comes to borrowing money, the Annual Percentage Rate (APR) is a crucial factor in determining the total cost of a loan. APR represents the annual cost of borrowing, including both the interest rate and any additional fees charged by the lender.

Unlike the nominal interest rate, which only considers the interest charged on the principal amount, APR provides a more comprehensive picture by incorporating all costs associated with the loan. This includes origination fees, discount points, and any other charges that borrowers may incur.

Impact of APR on Loan Costs

Here are a few examples that illustrate how APR can impact the overall cost of a loan:

- Example 1: Borrower A takes out a $10,000 loan with an APR of 5% and no additional fees. Over the course of one year, Borrower A would pay $500 in interest.

- Example 2: Borrower B also takes out a $10,000 loan but with an APR of 7% and an origination fee of $200. In this case, Borrower B would pay $700 in interest plus the $200 fee, resulting in a higher overall cost compared to Borrower A.

Impact of Loan Term on Interest Calculation

When it comes to calculating loan interest, the term of the loan plays a crucial role in determining the total amount of interest paid. Let’s dive into how the loan term affects the overall cost of borrowing.

Relationship Between Loan Term, Monthly Payments, and Interest Costs

The loan term directly impacts the monthly payments and interest costs associated with a loan. A longer loan term typically results in lower monthly payments but higher overall interest costs. On the other hand, a shorter loan term leads to higher monthly payments but lower total interest paid.

- Longer Loan Term:

- Lower monthly payments

- Higher total interest paid

- Extended repayment period

- Shorter Loan Term:

- Higher monthly payments

- Lower total interest paid

- Quicker repayment period

Remember, the longer you take to repay a loan, the more interest you will end up paying over time.