Yo, peeps! Let’s dive into the world of credit card interest explained, where we break down complex financial jargon into easy-to-understand bits. Get ready to level up your money game!

So, picture this: you swipe that card, and bam! Interest starts piling up. But don’t sweat it, we got your back with all the deets you need to know.

What is Credit Card Interest?

Credit card interest is the cost of borrowing money when you carry a balance on your credit card. It is calculated as a percentage of the amount you owe and is added to your balance each month if you do not pay off the full amount.

How is Credit Card Interest Calculated?

- Most credit card companies use the average daily balance method to calculate interest. This means they take the average of your balance each day during the billing cycle and multiply it by the daily interest rate.

- For example, if you have a balance of $1,000 on your credit card with an interest rate of 20% APR (Annual Percentage Rate), the daily interest rate would be approximately 0.055%. If the billing cycle is 30 days, the interest for the month would be calculated as $1,000 * 0.055% * 30 = $16.50.

Factors that Influence Credit Card Interest Rates

- Credit Score: A higher credit score typically means you qualify for lower interest rates, while a lower score may result in higher rates.

- Market Conditions: Economic factors and the Federal Reserve’s interest rate decisions can impact credit card interest rates.

- Card Type: Different types of credit cards (such as rewards cards or secured cards) may have different interest rates based on the features they offer.

Types of Credit Card Interest Rates

When it comes to credit card interest rates, there are a few key types to be aware of. Let’s break down the differences between fixed and variable rates, as well as how introductory and penalty rates can impact your finances.

Fixed vs. Variable Interest Rates

Fixed interest rates on credit cards remain the same over time, providing predictability in your monthly payments. On the other hand, variable interest rates can fluctuate based on changes in the market or the prime rate. While fixed rates offer stability, variable rates can sometimes lead to lower costs if interest rates drop.

Introductory Rates

Introductory rates are often offered by credit card companies to attract new customers. These rates are typically lower than the standard rates and can apply for a limited period, such as the first six months after opening an account. It’s important to pay attention to when the introductory period ends, as the rate will then adjust to the regular rate.

Penalty Interest Rates

Penalty interest rates are applied when you fail to make a payment on time or exceed your credit limit. These rates are significantly higher than the standard rates and can result in increased debt if not managed promptly. It’s crucial to understand the terms of your credit card agreement to avoid triggering penalty rates and incurring additional charges.

Understanding APR

When it comes to credit cards, APR stands for Annual Percentage Rate. This is the annual rate charged by credit card companies for borrowing money through the card.

APR differs from the nominal interest rate because it takes into account not only the interest charged on the principal amount but also any additional fees or charges associated with the credit card. The nominal interest rate, on the other hand, only considers the interest charged on the borrowed amount.

Importance of APR

- APR helps consumers understand the true cost of borrowing on a credit card, as it includes all fees and charges in addition to the interest rate.

- Comparing credit card offers based on APR allows consumers to make more informed decisions about which card may be the most cost-effective for their borrowing needs.

- Lower APR rates can save cardholders money in the long run, especially if they carry a balance on their credit card from month to month.

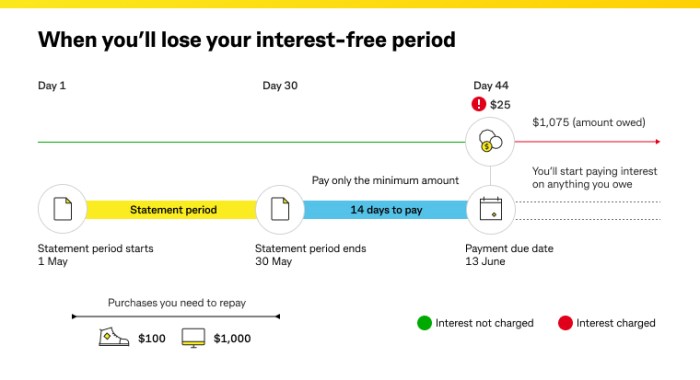

Impact of Minimum Payments on Interest

Making only the minimum payment on your credit card balance can have a significant impact on the amount of interest you end up paying in the long run. By understanding this impact, you can make better financial decisions to reduce your interest charges and pay off your balance more efficiently.

Increased Interest Costs

- Making only the minimum payment means you are carrying a balance from month to month, accruing interest on the remaining balance.

- Over time, the interest charges can add up significantly, leading to a higher overall cost of borrowing.

- For example, if you have a $1,000 balance on your credit card with an APR of 18% and you only make the minimum payment each month, it could take years to pay off the balance and result in paying hundreds or even thousands of dollars in interest.

Long-Term Financial Impact

- Making minimum payments can prolong the time it takes to pay off your credit card debt, keeping you in debt longer.

- By paying only the minimum, you may not make much progress in reducing the principal balance, leading to higher interest costs over time.

- Ultimately, the total amount you pay in interest can far exceed the initial amount borrowed if you only make minimum payments.

Strategies to Reduce Interest Charges

- Consider paying more than the minimum each month to reduce the principal balance faster and lower the amount of interest accrued.

- Look for opportunities to increase your monthly payments or make additional payments whenever possible to pay off the balance sooner.

- If you have multiple credit cards, focus on paying off the one with the highest interest rate first to save on interest costs.