Get ready to dive into the world of credit history reports, where understanding the ins and outs can make all the difference. From decoding key components to interpreting the data, this guide will equip you with the knowledge needed to navigate your financial landscape with confidence.

As we delve deeper into the realm of credit history reports, let’s explore the components, methods of obtaining, and the importance of a positive credit history report.

Introduction to Credit History Report

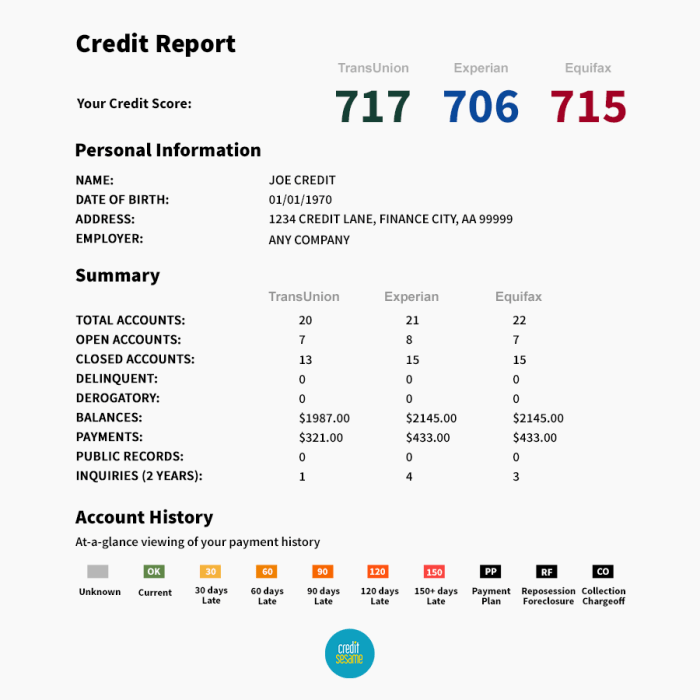

A credit history report is a detailed record of an individual’s credit activities, including credit accounts, payment history, and outstanding debts. It is maintained by credit bureaus and used by lenders to assess a person’s creditworthiness.

Importance of a Credit History Report

Your credit history report plays a crucial role in determining your ability to borrow money, obtain loans, and secure favorable interest rates. A positive credit history can open doors to better financial opportunities, while a negative credit history can limit your options and lead to higher costs.

Who Typically Accesses Credit History Reports

- Lenders: Banks, credit card companies, and other financial institutions use credit history reports to evaluate the risk of lending money to an individual.

- Landlords: Property owners often request credit history reports to assess a potential tenant’s financial responsibility.

- Employers: Some employers review credit history reports as part of the hiring process, especially for positions that involve financial responsibilities.

Components of a Credit History Report

Understanding the key components of a credit history report is crucial for managing your financial reputation. Each component provides valuable insight into your credit profile and influences your ability to secure loans, credit cards, or other financial opportunities.

Personal Information

Personal information includes your name, address, social security number, date of birth, and employment history. This information helps lenders verify your identity and assess your stability as a borrower.

Credit Accounts

Credit accounts section lists all your current and past credit accounts, such as credit cards, loans, and mortgages. It shows your payment history, credit limits, balances, and account statuses. For example, it may include details on a credit card balance of $500 with a credit limit of $1000.

Public Records

Public records reveal any bankruptcies, foreclosures, tax liens, or court judgments against you. These negative marks can significantly impact your credit score and make it challenging to qualify for new credit.

Inquiries

The inquiries section shows who has requested a copy of your credit report. Hard inquiries, which occur when you apply for credit, can temporarily lower your credit score. Soft inquiries, like those from potential employers or yourself, do not affect your score.

Credit Score

Though not a component per se, your credit score is often included in your credit history report. It summarizes your creditworthiness based on the information in the report. A higher credit score indicates lower credit risk and vice versa.

Obtaining a Credit History Report

When it comes to obtaining a credit history report, there are several methods available to individuals seeking this information. Whether you prefer to request it online, by phone, or through the mail, each option has its own set of procedures and requirements.

Different Methods for Obtaining a Credit History Report

- Online: Many credit bureaus offer the option to request your credit report online through their website. This method is quick and convenient, allowing you to access your report almost instantly.

- By Phone: Another way to obtain your credit history report is by calling the credit bureau directly. You will need to provide certain information to verify your identity before the report is sent to you.

- By Mail: If you prefer a more traditional approach, you can request your credit report by mail. Simply fill out a form provided by the credit bureau and send it back along with the necessary documentation.

Comparison of Credit Report Retrieval from Different Credit Bureaus

| Credit Bureau | Online Request | Phone Request | Mail Request |

|---|---|---|---|

| Equifax | Available | Available | Available |

| Experian | Available | Available | Available |

| TransUnion | Available | Available | Available |

Fees Associated with Accessing a Credit History Report

While federal law entitles you to a free credit report from each of the major credit bureaus once a year, additional requests may come with a fee. Some credit bureaus offer subscription services for ongoing access to your credit report, which may involve monthly or annual charges. It’s important to be aware of any fees associated with accessing your credit history report and to understand the terms and conditions before proceeding.

Interpreting a Credit History Report

Understanding how to read and interpret a credit history report is crucial for managing your financial well-being. This report provides a detailed summary of your credit activity and helps lenders assess your creditworthiness.

Common Terms and Codes in Credit Reports

- Credit Score: A numerical representation of your creditworthiness, typically ranging from 300 to 850. The higher the score, the better.

- Payment History: Indicates whether you have paid your bills on time. Late payments can negatively impact your credit score.

- Credit Utilization Ratio: The percentage of your available credit that you are currently using. Keeping this ratio low is important for a healthy credit profile.

- Accounts in Good Standing: Shows the number of accounts where you have made timely payments and have a positive credit history.

- Derogatory Marks: Negative items on your credit report, such as bankruptcies or collections, that can harm your credit score.

Tips for Understanding and Analyzing the Information

- Review your personal information: Ensure all details are accurate, including your name, address, and social security number.

- Check for errors: Look for any discrepancies in account balances, payment history, or unfamiliar accounts that could be signs of identity theft.

- Understand your credit utilization: Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

- Monitor changes over time: Regularly check your credit report to track improvements or identify any concerning trends that may need addressing.

- Seek professional help if needed: If you have trouble interpreting your credit report or need assistance improving your credit, consider consulting a financial advisor or credit counselor.

Importance of a Good Credit History Report

Having a positive credit history report is crucial in today’s financial world. It can open doors to various opportunities and benefits that can greatly impact an individual’s financial well-being.

A good credit history report can benefit an individual financially in several ways:

Lower Interest Rates

- Individuals with a good credit history report are more likely to qualify for loans and credit cards with lower interest rates.

- Lower interest rates mean lower monthly payments, saving money in the long run.

Access to More Financial Options

- With a good credit history report, individuals have access to a wider range of financial products and services, such as mortgages, car loans, and personal loans.

- Having more options allows individuals to choose the best terms and conditions that suit their needs.

Employment Opportunities

- Employers in certain industries may check an individual’s credit history report as part of the hiring process.

- A positive credit history report can demonstrate financial responsibility and trustworthiness, potentially improving job prospects.

A good credit history report is essential in situations where financial credibility is paramount, such as when applying for a mortgage, renting an apartment, or even setting up utilities. It serves as a reflection of an individual’s financial habits and can influence decisions made by lenders, landlords, and even potential employers.