With how to dispute credit report errors at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Understanding credit report errors, identifying discrepancies, and disputing inaccuracies are crucial steps in maintaining a healthy credit score. Let’s dive into the world of credit reports and errors to uncover the secrets of financial wellness.

Understanding Credit Report Errors

When it comes to credit report errors, these are inaccuracies or mistakes found on your credit report that can negatively impact your credit score and financial health. It is essential to identify and correct these errors promptly to maintain a healthy credit profile.

Examples of Common Credit Report Errors

- Incorrect personal information such as name, address, or social security number

- Accounts that do not belong to you or were mistakenly reported as delinquent

- Inaccurate payment history showing missed or late payments that did not occur

- Duplicate accounts listed on your report

- Fraudulent activity such as identity theft

Impact of Credit Report Errors on Credit Scores

- Credit report errors can lower your credit score, making it more challenging to qualify for loans, credit cards, or favorable interest rates.

- They can lead to higher insurance premiums, security deposits, or even denial of rental applications.

- Inaccurate information can affect your ability to secure employment, as some employers review credit reports as part of the hiring process.

Identifying Credit Report Errors

When it comes to your credit report, it’s crucial to spot any errors that could potentially harm your financial health. Here’s how you can identify credit report errors:

Obtain a Free Copy of Your Credit Report

To get started, you can request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau every 12 months through AnnualCreditReport.com.

Review Your Credit Report for Errors

Once you have your credit reports in hand, carefully review each one for any inaccuracies or discrepancies. Pay close attention to personal information, account details, payment history, and any negative items such as late payments or collections.

Identify Inaccuracies or Discrepancies

Look for any errors such as accounts that don’t belong to you, incorrect account balances, duplicate entries, or outdated information. If you spot any discrepancies, make a note of them and gather any supporting documents that can help you dispute these errors with the credit bureaus.

Disputing Credit Report Errors

When it comes to disputing credit report errors, it’s crucial to follow the correct steps to ensure accuracy and fairness in your credit history. Documenting errors and knowing how to contact credit bureaus are key components of this process.

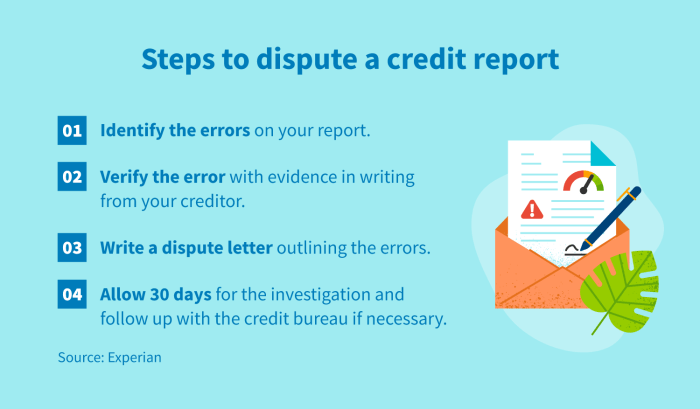

Steps to Dispute Credit Report Errors

- Obtain a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Review each report carefully to identify any errors, such as incorrect personal information, accounts that don’t belong to you, or inaccurate payment history.

- Document each error with details, including the date, the specific information that is incorrect, and any supporting documentation you have.

- Write a dispute letter to the credit bureau(s) reporting the error, clearly stating the inaccuracies and providing evidence to support your claim.

- Send the dispute letter via certified mail with a return receipt requested to ensure it is received and processed.

- Follow up with the credit bureau(s) after about 30 days if you haven’t received a response, and keep records of all correspondence.

Importance of Documenting Errors

Documenting errors on your credit report is crucial because it provides evidence to support your dispute. By keeping detailed records of the inaccuracies, you can strengthen your case and increase the likelihood of a successful resolution.

Tips on Contacting Credit Bureaus to Dispute Errors

- Use the contact information provided on your credit report to reach out to the credit bureaus.

- Be clear, concise, and professional in your communication, providing specific details about the errors and the corrections you are requesting.

- Keep a log of all phone calls, emails, and letters sent to the credit bureaus, including dates and names of representatives you spoke with.

- Stay persistent and follow up regularly to ensure your dispute is being addressed in a timely manner.

Providing Supporting Documentation

When disputing credit report errors, it’s essential to provide supporting documentation to back up your claims. This documentation can help strengthen your case and increase the chances of the errors being corrected in your favor.

Types of Supporting Documentation

- Proof of Identity: Provide a copy of your driver’s license, passport, or other official identification documents to verify your identity.

- Proof of Address: Utility bills, lease agreements, or other official documents showing your current address can help confirm your residency.

- Payment Records: Bank statements, receipts, or payment confirmations can demonstrate that you’ve made timely payments on accounts in question.

- Correspondence: Any letters, emails, or communication with the credit reporting agency or creditor regarding the errors should be included.

Organizing and Submitting Documentation

- Gather all relevant documentation in a clear, organized manner, making it easy for the credit reporting agency to review.

- Make copies of all documents and keep the originals for your records before submitting them.

- Submit the documentation through the credit reporting agency’s online dispute portal, via mail, or fax, following their specific instructions.

- Keep track of when and how you submitted the documentation, and follow up to ensure it has been received and reviewed.