Get ready to dive into the world of loan amortization schedule, where we break down the complex components in a way that’s easy to understand. From calculating loan payments to exploring repayment strategies, this guide has got you covered.

Loan Amortization Schedule Overview

When it comes to borrowing money for big purchases like a house or a car, understanding the concept of a loan amortization schedule is key. This schedule breaks down how much of each loan payment goes towards the principal amount and how much goes towards interest over the life of the loan.

Definition of a Loan Amortization Schedule

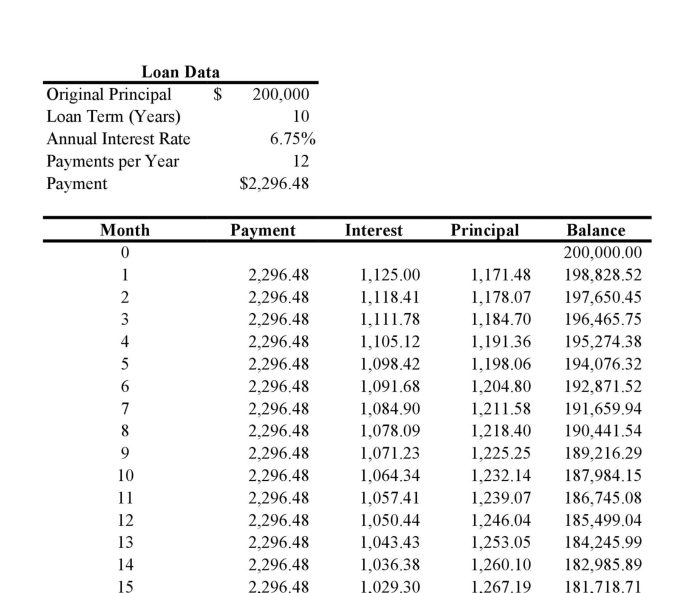

A loan amortization schedule is a table that shows the breakdown of each loan payment into principal and interest components. It helps borrowers visualize how their loan balance decreases over time as they make payments.

Importance of Understanding Loan Amortization Schedules

- It helps in planning monthly budgets by knowing how much of each payment goes towards interest and principal.

- It allows borrowers to see the total cost of the loan over its term and make informed decisions.

- It assists in understanding the impact of extra payments or early payoffs on the loan balance.

Understanding loan amortization schedules is crucial for borrowers because:

Components of a Typical Loan Amortization Schedule

| Payment Number | Total Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| 1 | $500 | $300 | $200 | $10,000 |

| 2 | $500 | $302 | $198 | $9,698 |

Calculating Loan Payments

When it comes to calculating loan payments based on an amortization schedule, it’s important to understand the formula used and how different factors like loan amount, interest rate, and loan term impact the monthly payments.

To calculate loan payments, the formula used is:

Payment = P * r(1 + r)^n / ((1 + r)^n – 1)

Where:

– P = Principal loan amount

– r = Monthly interest rate (annual interest rate divided by 12)

– n = Total number of payments (loan term in years multiplied by 12)

Example 1: Calculating Monthly Payments for a Fixed-Rate Mortgage

Let’s say you have a $200,000 fixed-rate mortgage with an annual interest rate of 4% and a 30-year loan term.

First, calculate the monthly interest rate: 4% / 12 = 0.00333

Next, calculate the total number of payments: 30 years * 12 = 360 payments

Now, plug these values into the formula to find the monthly payment.

Example 2: Calculating Monthly Payments for an Auto Loan

For an auto loan of $25,000 with an annual interest rate of 6% and a 5-year loan term:

Monthly interest rate = 6% / 12 = 0.005

Total number of payments = 5 years * 12 = 60 payments

Use the formula to calculate the monthly payment amount.

Impact of Loan Amount, Interest Rate, and Loan Term

– Higher loan amounts lead to higher monthly payments.

– Higher interest rates increase monthly payments.

– Longer loan terms result in lower monthly payments but higher overall interest paid.

Understanding Amortization Tables

When it comes to understanding loan payments, amortization tables play a crucial role in breaking down how each payment is allocated between interest and principal. These tables provide a detailed schedule of payments over the life of the loan, helping borrowers visualize how their debt decreases over time.

Structure of an Amortization Table

An amortization table is typically structured with columns showing the payment number, total monthly payment, the portion allocated to interest, the portion allocated to principal, and the remaining balance of the loan. Each row represents a specific payment period, usually monthly.

- The payment number column indicates the sequence of payments made throughout the loan term.

- The total monthly payment column shows the amount the borrower must pay each month to cover both interest and principal.

- The interest portion column displays the amount of the monthly payment that goes towards interest charges.

- The principal portion column illustrates how much of the monthly payment goes towards reducing the loan balance.

- The remaining balance column reveals the outstanding loan amount after each payment is made.

Understanding how to read an amortization table is essential for borrowers to track their progress in paying off the loan and managing their finances effectively.

Significance of Interest and Principal Portions

In an amortization table, the interest portion of the payment is higher at the beginning of the loan term, gradually decreasing over time. On the other hand, the principal portion starts off small but increases with each payment. This structure reflects how loans are front-loaded with interest, meaning borrowers pay more towards interest in the early stages of the loan.

- By understanding the breakdown of interest and principal in each payment, borrowers can see how much of their money is going towards reducing the loan balance.

- As the loan progresses, a larger portion of each payment goes towards paying down the principal, accelerating the reduction of the overall debt.

- Amortization tables help borrowers make informed decisions about extra payments or refinancing options to potentially save on interest costs and pay off the loan sooner.

Loan Repayment Strategies

When it comes to paying off a loan faster, there are several strategies you can use to save on interest and become debt-free sooner. By utilizing an amortization schedule, you can visualize the impact of different repayment strategies and make informed decisions to achieve financial freedom.

Making Extra Payments Towards the Principal

Extra payments towards the principal amount of your loan can significantly reduce the total interest paid over the life of the loan. By allocating additional funds towards the principal balance, you can shorten the repayment period and save money in the long run. This strategy is effective in accelerating the payoff process and decreasing the overall cost of borrowing.

Increasing Monthly Payments

Another approach to repay a loan faster is by increasing your monthly payments. By paying more than the minimum amount due each month, you can reduce the outstanding balance quicker and lower the total interest accrued. This method allows you to expedite the repayment process without the need for a lump sum payment, making it a feasible option for borrowers looking to save on interest costs.

Bi-Weekly Payments

Making bi-weekly payments instead of monthly payments can also lead to significant interest savings and faster loan repayment. By splitting your monthly payment in half and paying every two weeks, you end up making an extra month’s worth of payments each year. This results in paying off the loan sooner and reducing the total interest paid over the term of the loan.