Personal loan interest rates set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we dive into the world of personal loan interest rates, we uncover the key factors, types, strategies, and comparisons that shape this financial landscape.

Factors affecting personal loan interest rates

When it comes to personal loan interest rates, several factors come into play that can influence how much you’ll end up paying. Understanding these factors can help you make more informed decisions when taking out a personal loan.

Credit score impact

Your credit score plays a significant role in determining the interest rate you’ll be offered on a personal loan. Lenders use your credit score to assess your creditworthiness and determine the risk of lending to you. A higher credit score typically results in lower interest rates, as it signals to lenders that you are more likely to repay the loan on time.

Loan amount influence

The amount you borrow can also impact the interest rate on your personal loan. In general, larger loan amounts may come with lower interest rates, as lenders can spread the risk over a larger sum of money. However, it’s important to note that some lenders may offer higher interest rates for larger loans to offset the increased risk.

Loan term length effect

The length of your loan term can affect the interest rate you’re offered on a personal loan. Generally, shorter loan terms often come with lower interest rates, as lenders are taking on less risk over a shorter period. On the other hand, longer loan terms may have higher interest rates to compensate for the extended repayment period.

Fixed vs. variable rates

When taking out a personal loan, you’ll typically have the option to choose between fixed and variable interest rates. Fixed interest rates remain the same throughout the life of the loan, providing predictability in your monthly payments. On the other hand, variable interest rates can fluctuate based on market conditions, potentially leading to changes in your monthly payments.

Understanding the different types of personal loan interest rates

When it comes to personal loan interest rates, it’s crucial to understand the different types that exist. Let’s take a deeper look into secured and unsecured personal loan interest rates, as well as the concept of APR and introductory rates.

Secured Personal Loan Interest Rates

Secured personal loans are backed by collateral, such as a car or a house. Due to the reduced risk for the lender, interest rates for secured personal loans are typically lower compared to unsecured loans. For example, a secured personal loan might have an interest rate of 5% to 10%.

Unsecured Personal Loan Interest Rates

In contrast, unsecured personal loans do not require collateral. Because of the higher risk for the lender, interest rates for unsecured personal loans are usually higher than secured loans. An unsecured personal loan could have an interest rate ranging from 10% to 20%.

APR and Its Significance

APR stands for Annual Percentage Rate, which includes the interest rate and any additional fees charged by the lender. It provides a more comprehensive view of the total cost of borrowing. When comparing personal loan offers, it’s essential to consider the APR to understand the true cost of the loan.

Introductory Rates in Personal Loans

Introductory rates are temporary lower interest rates offered by lenders to attract borrowers. These rates are usually promotional and can change after a specified period, often increasing significantly. Borrowers should carefully review the terms and conditions to understand how introductory rates impact the overall cost of the loan.

Strategies to lower personal loan interest rates

When it comes to personal loans, finding ways to lower the interest rates can save you money in the long run. Here are some strategies to help you secure a lower interest rate on your personal loan:

Improving credit score

One of the most effective ways to qualify for lower interest rates on a personal loan is by improving your credit score. Lenders typically offer better rates to borrowers with higher credit scores, as they are considered less risky. To boost your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening multiple new credit accounts.

Loan refinancing

Another option to secure lower interest rates on your personal loan is by refinancing your existing loan. Refinancing involves taking out a new loan to pay off the existing one, usually at a lower interest rate. This can help you save money on interest payments over time, especially if your credit score has improved since you originally took out the loan.

Negotiating with lenders

Don’t be afraid to negotiate with lenders to potentially lower your interest rate. If you have a good payment history or a strong credit score, you may be able to leverage these factors to negotiate a lower rate. Be prepared to shop around and compare offers from different lenders to find the best deal.

Minimizing fees

In addition to interest rates, personal loans may come with various fees, such as origination fees, late payment fees, or prepayment penalties. To minimize these costs, make sure to read the loan agreement carefully and understand all the fees associated with the loan. Look for lenders that offer loans with no or low fees to save money in the long term.

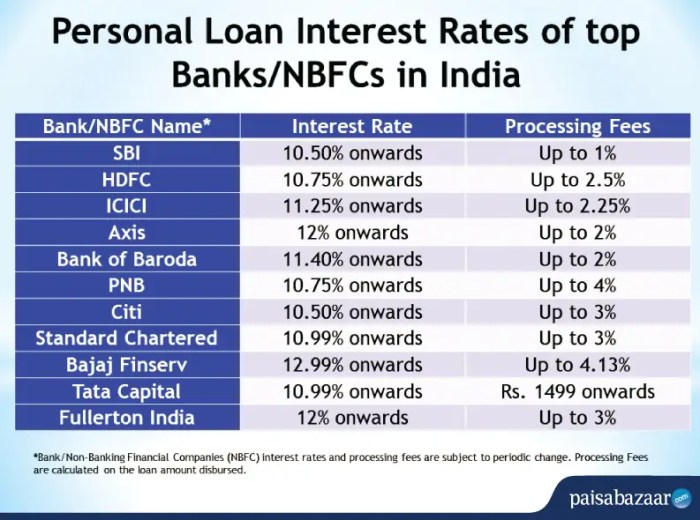

Comparing personal loan interest rates across different lenders

When looking to take out a personal loan, one of the key factors to consider is the interest rate offered by different lenders. Comparing interest rates across various banks or financial institutions can help you find the best deal that suits your financial situation. Let’s explore how you can compare personal loan interest rates effectively.

Interest Rate Comparison Table

| Lender | Interest Rate |

|---|---|

| Bank A | 5.25% |

| Bank B | 6.00% |

| Bank C | 4.75% |

Other Factors to Consider when Choosing a Lender

- Loan terms and conditions

- Processing fees

- Customer service quality

- Reputation of the lender

Impact of Market Trends on Personal Loan Interest Rates

Market trends play a significant role in determining personal loan interest rates. When the economy is performing well, interest rates may increase, while during economic downturns, rates might decrease. It’s essential to stay informed about market trends to make informed decisions about personal loans.

Relationship Discounts and Autopay Discounts

Relationship discounts and autopay discounts can lower your interest rates significantly, helping you save money over the life of the loan.

By having an existing relationship with a lender or enrolling in autopay, you may be eligible for discounts on your interest rates, making it a cost-effective option for borrowers.