Yo, diving into the world of mortgage loans, where we break down the different types and options available. Get ready to learn about fixed-rate, adjustable-rate, government-backed loans, jumbo loans, and interest-only mortgages. It’s gonna be lit!

Overview of Mortgage Loans

Mortgage loans are like a boss move when you want to buy a crib but don’t have all the cash upfront. Basically, you borrow money from a lender to buy a house and then pay it back over time, plus interest. It’s like a long-term investment in your future pad.

Types of Mortgage Loans

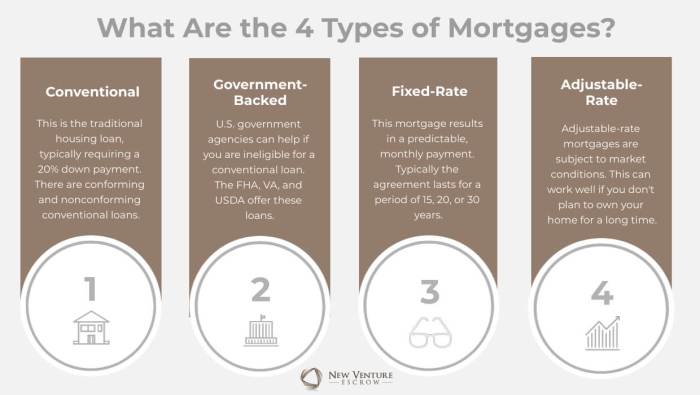

When it comes to mortgage loans, there are some major players in the game. Check it:

- Conventional Loans: These are like the OGs of mortgage loans. They’re not backed by the government and usually require a higher credit score and down payment.

- FHA Loans: These loans are backed by the Federal Housing Administration and are great for peeps who don’t have a huge down payment or have lower credit scores.

- VA Loans: These loans are for the troops and are backed by the Department of Veterans Affairs. If you’ve served in the military, you might be able to score one of these bad boys.

- USDA Loans: These loans are for rural areas and are backed by the U.S. Department of Agriculture. If you’re looking to buy a house in the country, this might be your ticket.

Importance of Understanding Different Mortgage Options

Yo, it’s crucial to know your options when it comes to mortgage loans. Each type has its own perks and downsides, so you wanna make sure you pick the one that fits your financial situation best. Don’t sleep on this decision, ‘cause it could have a major impact on your future finances.

Fixed-Rate Mortgages

Fixed-rate mortgages are home loans with interest rates that remain constant throughout the life of the loan. This means that your monthly payment amount will also stay the same, providing stability and predictability in your housing expenses.

Comparison with Adjustable-Rate Mortgages

Fixed-rate mortgages differ from adjustable-rate mortgages (ARMs), where the interest rate can change periodically based on market conditions. With fixed-rate mortgages, borrowers don’t have to worry about their payments increasing unexpectedly due to fluctuating interest rates.

Benefits and Drawbacks

- Benefits:

- Stability: Monthly payments remain constant, making budgeting easier.

- Predictability: Knowing exactly how much you need to pay each month can help with financial planning.

- Protection: Shielded from rising interest rates, providing peace of mind.

- Drawbacks:

- Higher Initial Rates: Fixed-rate mortgages often come with slightly higher initial interest rates compared to ARMs.

- Less Flexibility: If interest rates drop significantly, you won’t benefit unless you refinance.

- Potential Cost: Refinancing can come with costs, such as closing fees, which may offset potential savings.

Adjustable-Rate Mortgages (ARM)

Adjustable-Rate Mortgages, commonly known as ARMs, are home loans with interest rates that can fluctuate over time based on market conditions. Unlike fixed-rate mortgages, where the interest rate remains the same for the entire loan term, ARMs offer an initial fixed period followed by adjustments at regular intervals.

How ARMs Function

Adjustable-Rate Mortgages typically start with a lower interest rate compared to fixed-rate mortgages, making them attractive to borrowers looking for initial cost savings. The initial fixed period, often ranging from 3 to 10 years, provides stability before the rate adjustments begin. After this period, the interest rate can change periodically based on the index it is tied to, such as the prime rate or the London Interbank Offered Rate (LIBOR).

- Factors Influencing Interest Rate Changes in ARMs:

Adjustable-Rate Mortgages are influenced by several factors that determine how the interest rate adjustments are made. These factors include the index used for the rate calculation, the margin set by the lender, and any caps or limits on how much the rate can change in a given period.

Suitable Situations for ARMs

Adjustable-Rate Mortgages can be a good choice for borrowers who plan to sell or refinance their home before the initial fixed period ends. In situations where interest rates are expected to decrease or if the borrower anticipates an increase in income, an ARM can provide short-term cost savings. Additionally, ARMs are suitable for borrowers who believe they can handle potential rate increases in the future or for those who do not plan to stay in the home for a long time.

Government-Backed Loans

Government-backed mortgage loan programs are designed to help make homeownership more accessible to a wider range of individuals. These programs are insured by government agencies, providing lenders with more security, which in turn allows borrowers to qualify for loans with more favorable terms.

FHA Loans

FHA loans are insured by the Federal Housing Administration and are popular among first-time homebuyers. These loans require a lower down payment compared to conventional loans, making them more accessible to those with limited savings. Borrowers with lower credit scores may also qualify for an FHA loan.

VA Loans

VA loans are specifically for military service members, veterans, and their families. These loans are guaranteed by the Department of Veterans Affairs and offer benefits such as no down payment requirement and lower interest rates. Eligibility is based on military service and discharge status.

USDA Loans

USDA loans are backed by the U.S. Department of Agriculture and are aimed at promoting homeownership in rural areas. These loans offer 100% financing, meaning no down payment is required. Borrowers must meet income eligibility requirements and the property must be located in a designated rural area.

Advantages of Government-Backed Loans

- Lower down payment requirements

- More flexible credit score requirements

- Competitive interest rates

- Special benefits for specific groups (such as military service members)

Jumbo Loans

Jumbo loans are mortgages that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are typically used for high-priced properties that require larger loan amounts.

Differences Between Jumbo Loans and Conventional Loans

When comparing jumbo loans to conventional loans, the main differences lie in the loan amounts and qualification requirements. Jumbo loans involve borrowing larger sums of money than conventional loans and often come with stricter credit score and income requirements.

- Jumbo loans are non-conforming loans, meaning they do not meet the guidelines set by government-sponsored enterprises like Fannie Mae and Freddie Mac.

- Interest rates for jumbo loans are usually higher than those for conventional loans due to the increased risk for lenders.

- Borrowers may need a higher down payment for jumbo loans compared to conventional loans.

Qualification Requirements for Jumbo Loans

To qualify for a jumbo loan, borrowers typically need to meet the following criteria:

- Strong credit score: Lenders usually require a credit score of 700 or higher for jumbo loans.

- Low debt-to-income ratio: Borrowers should have a low debt-to-income ratio to show they can manage the higher loan amount.

- Large down payment: A down payment of 20% or more is common for jumbo loans.

- Reserve requirements: Lenders may ask for a certain amount of reserves to cover mortgage payments in case of financial difficulties.

Interest-Only Mortgages

Interest-only mortgages are a type of home loan where the borrower only pays the interest on the loan for a set period, typically 5-10 years. During this time, the borrower does not pay down the principal balance, resulting in lower monthly payments compared to a traditional mortgage.

How Interest-Only Mortgages Work

Interest-only mortgages allow borrowers to make lower monthly payments initially by only paying the interest on the loan. This can be beneficial for those who expect their income to increase in the future or plan to sell the property before the principal payments kick in.

- Pros of Interest-Only Mortgages:

- Lower initial monthly payments

- Flexibility for borrowers with irregular income

- Ability to invest the money that would have gone towards principal payments

- Cons of Interest-Only Mortgages:

- Higher overall interest costs over the life of the loan

- Potential for payment shock when principal payments begin

- Risk of not building equity in the property

Scenarios where Interest-Only Mortgages can be Beneficial

Interest-only mortgages can be beneficial for borrowers who plan to move or refinance within a few years, real estate investors looking to maximize cash flow, or individuals with fluctuating incomes. Additionally, those who prioritize investment opportunities over home equity may find interest-only mortgages appealing.