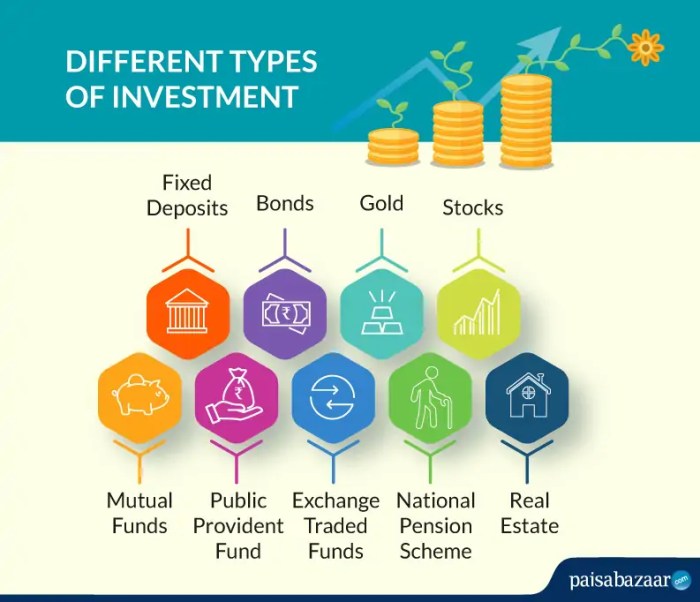

Diving into the realm of financial investments, we uncover the various types and strategies that shape the landscape of wealth management. From stocks to real estate, each avenue offers unique opportunities and challenges that investors navigate to build their financial portfolios.

Types of Financial Investments

Financial investments play a crucial role in wealth management as they allow individuals to grow their money over time. By investing in different asset classes, investors can diversify their portfolios and potentially earn higher returns than traditional savings accounts.

Stocks

Stocks represent ownership in a company and are considered one of the most popular types of financial investments. Investors can buy shares of publicly traded companies and earn returns through capital appreciation and dividends. Stocks offer the potential for high returns but also come with high volatility and risk.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. Investors who purchase bonds essentially lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks but offer lower returns.

Real Estate

Investing in real estate involves purchasing properties with the expectation of generating rental income or capital appreciation. Real estate investments can provide a steady income stream and serve as a hedge against inflation. However, they require significant capital and come with risks such as property market fluctuations.

Commodities

Commodities are physical goods such as gold, oil, and agricultural products that are traded on exchanges. Investors can buy commodities directly or invest in commodity futures contracts. Commodities serve as a diversification tool in a portfolio and can act as a hedge against inflation and currency devaluation.

Liquidity Comparison

When it comes to liquidity, stocks are generally more liquid than bonds, real estate, and commodities. Stocks can be easily bought and sold on stock exchanges, providing investors with quick access to their funds. On the other hand, real estate and commodities may have longer holding periods and require more time and effort to convert into cash.

Stocks

Stocks represent ownership in a company, giving investors a share of the company’s assets and earnings. When you buy a stock, you become a shareholder, which means you have a claim on the company’s profits and assets.

Types of Stocks

There are two main types of stocks: common stocks and preferred stocks.

- Common Stocks: Most stocks traded on the stock market are common stocks. Shareholders have voting rights and may receive dividends, but their claims on assets are subordinate to bondholders and preferred stockholders.

- Preferred Stocks: Preferred stockholders have a higher claim on assets and earnings than common stockholders. They typically receive fixed dividends and do not have voting rights.

Factors Influencing Stock Prices

Several factors can influence stock prices:

- Company Performance: Strong financial performance, growth prospects, and profitability can drive stock prices up.

- Market Conditions: Economic indicators, interest rates, and market trends can impact stock prices.

- Investor Sentiment: News, rumors, and market speculation can affect how investors perceive a stock’s value.

Advantages and Disadvantages of Investing in Stocks

Investing in stocks has its pros and cons:

- Advantages:

- Potential for High Returns: Stocks have the potential for significant capital appreciation over time.

- Liquidity: Stocks are easily bought and sold on the stock market.

- Disadvantages:

- Volatility: Stock prices can be volatile, leading to potential losses in a short period.

- Risk of Loss: There is a risk of losing your investment if the company performs poorly or goes bankrupt.

Bonds

Bonds are debt securities issued by entities such as governments, corporations, or municipalities to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Types of Bonds

- Government Bonds: Issued by governments to finance public projects or cover budget deficits. Examples include US Treasury bonds and municipal bonds.

- Corporate Bonds: Issued by companies to raise funds for various purposes, such as expansion or operational needs. These bonds typically offer higher yields but come with higher risks.

- Municipal Bonds: Issued by local governments or agencies to fund infrastructure projects like schools or roads. Interest income from municipal bonds is often exempt from federal taxes.

Bond Prices, Interest Rates, and Yields

When interest rates rise, bond prices tend to fall, and vice versa. This is because existing bonds with lower interest rates become less attractive compared to newly issued bonds with higher rates. Bond yield, on the other hand, represents the annual return an investor can expect to receive on a bond, taking into account its price and interest payments.

Risk and Return Profiles

- Government Bonds: Generally considered the safest, as they are backed by the full faith and credit of the issuing government. They offer lower returns but are less risky.

- Corporate Bonds: Carry higher risk due to the financial health of the issuing company. However, they often provide higher yields to compensate for the increased risk.

- Municipal Bonds: Fall between government and corporate bonds in terms of risk and return. They are tax-exempt and are backed by the revenue generated from specific projects.

Real Estate

Real estate investments involve purchasing, owning, managing, renting, and/or selling properties for profit. Investors can choose various ways to invest in real estate, such as buying rental properties, investing in real estate investment trusts (REITs), or flipping properties for a quick profit.

Factors Influencing Real Estate Value

Factors that influence the value of real estate investments include location, market trends, property condition, economic conditions, interest rates, and demographic shifts. A prime location with high demand, positive market trends, and well-maintained properties can lead to higher property values and potential returns for investors.

- Location: Proximity to amenities, schools, transportation, and job opportunities can significantly impact property values.

- Market Trends: Understanding market trends, supply and demand dynamics, and economic indicators can help investors make informed decisions.

- Property Condition: Well-maintained properties, renovations, and upgrades can increase property values and attract tenants or buyers.

Advantages of Real Estate Investing

Investing in real estate offers several advantages, including potential rental income, property appreciation, tax benefits, diversification of investment portfolio, and leverage through mortgage financing. Rental income from tenants can provide a steady cash flow, while property values can appreciate over time, increasing the investor’s equity.

Real estate investments offer the potential for passive income, tax advantages, and long-term wealth accumulation.

Risks and Mitigation Strategies

Risks associated with real estate investments include market fluctuations, property vacancies, unexpected expenses, and liquidity constraints. To mitigate these risks, investors can conduct thorough market research, maintain a financial buffer for emergencies, diversify their real estate holdings, and consider working with experienced professionals such as real estate agents and property managers.

- Market Fluctuations: Stay informed about market trends and economic indicators to anticipate potential changes in property values.

- Property Vacancies: Have a contingency plan for vacancies, such as setting aside funds for maintenance and marketing to attract new tenants.

- Liquidity Constraints: Real estate investments are relatively illiquid, so investors should plan for long-term holding periods or consider alternative investment options for short-term liquidity needs.

Commodities

Investing in commodities involves trading raw materials or primary agricultural products that can be bought and sold. These can include items like gold, oil, corn, and coffee.

Types of Commodities

- Precious Metals: Examples include gold, silver, and platinum, which are often used as stores of value or for industrial purposes.

- Energy Commodities: This category includes crude oil, natural gas, and gasoline, vital for powering various industries and vehicles.

- Agricultural Commodities: Wheat, corn, soybeans, and coffee are some examples of agricultural products that fall under this category.

Factors Affecting Commodity Prices

- Supply and Demand Dynamics: Changes in supply or demand for a particular commodity can significantly impact its price.

- Geopolitical Events: Political instability or conflicts in regions where commodities are produced can lead to price fluctuations.

- Economic Indicators: Factors like inflation rates, interest rates, and economic growth can influence commodity prices.

Advantages and Disadvantages of Investing in Commodities

- Advantages:

1. Diversification: Commodities can offer a hedge against stock market volatility.

2. Inflation Protection: Commodities tend to perform well during inflationary periods. - Disadvantages:

1. Volatility: Prices of commodities can be highly volatile, leading to potential losses.

2. Lack of Income: Commodities do not generate regular income like dividends from stocks.